Authors

Summary

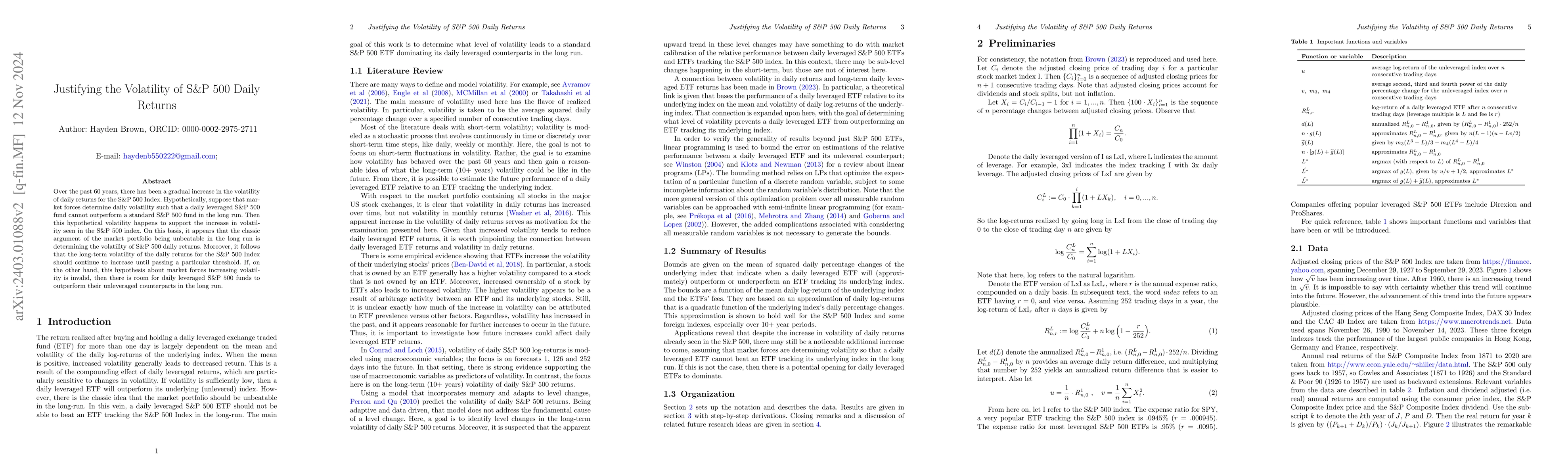

Over the past 60 years, there has been a gradual increase in the volatility of daily returns for the S&P 500 Index. Hypothetically, suppose that market forces determine daily volatility such that a daily leveraged S&P 500 fund cannot outperform a standard S&P 500 fund in the long run. Then this hypothetical volatility happens to support the increase in volatility seen in the S&P 500 index. On this basis, it appears that the classic argument of the market portfolio being unbeatable in the long run is determining the volatility of S&P 500 daily returns. Moreover, it follows that the long-term volatility of the daily returns for the S&P 500 Index should continue to increase until passing a particular threshold. If, on the other hand, this hypothesis about market forces increasing volatility is invalid, then there is room for daily leveraged S&P 500 funds to outperform their unleveraged counterparts in the long run.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)