Authors

Summary

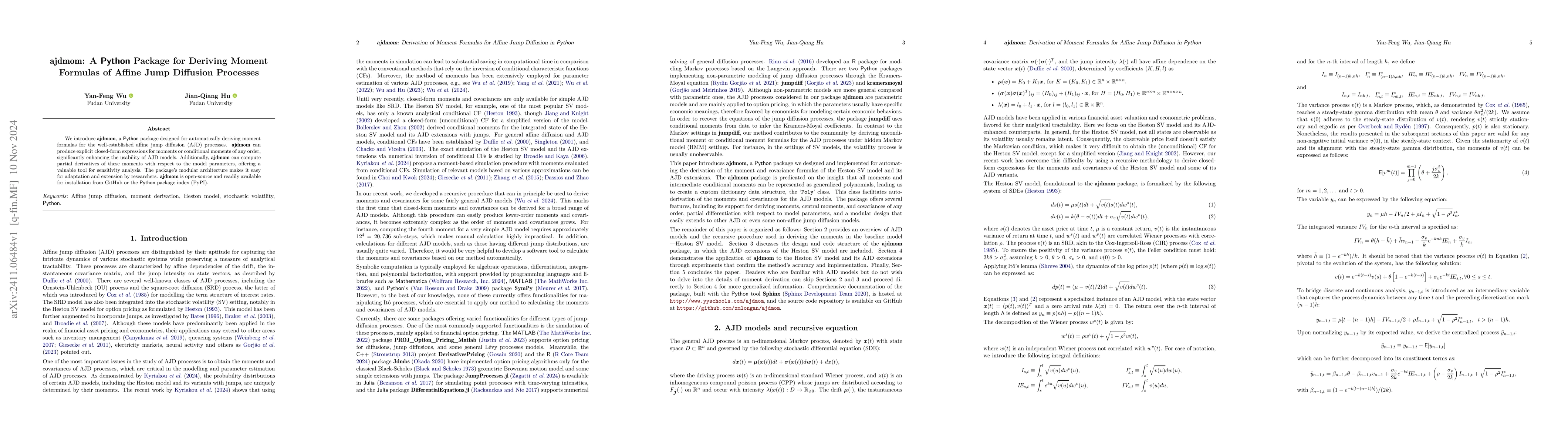

We introduce ajdmom, a Python package designed for automatically deriving moment formulas for the well-established affine jump diffusion (AJD) processes. ajdmom can produce explicit closed-form expressions for moments or conditional moments of any order, significantly enhancing the usability of AJD models. Additionally, ajdmom can compute partial derivatives of these moments with respect to the model parameters, offering a valuable tool for sensitivity analysis. The package's modular architecture makes it easy for adaptation and extension by researchers. ajdmom is open-source and readily available for installation from GitHub or the Python package index (PyPI).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDensity Approximation of Affine Jump Diffusions via Closed-Form Moment Matching

Yan-Feng Wu, Jian-Qiang Hu

Affine pure-jump processes on positive Hilbert-Schmidt operators

Asma Khedher, Sonja Cox, Sven Karbach

| Title | Authors | Year | Actions |

|---|

Comments (0)