Authors

Summary

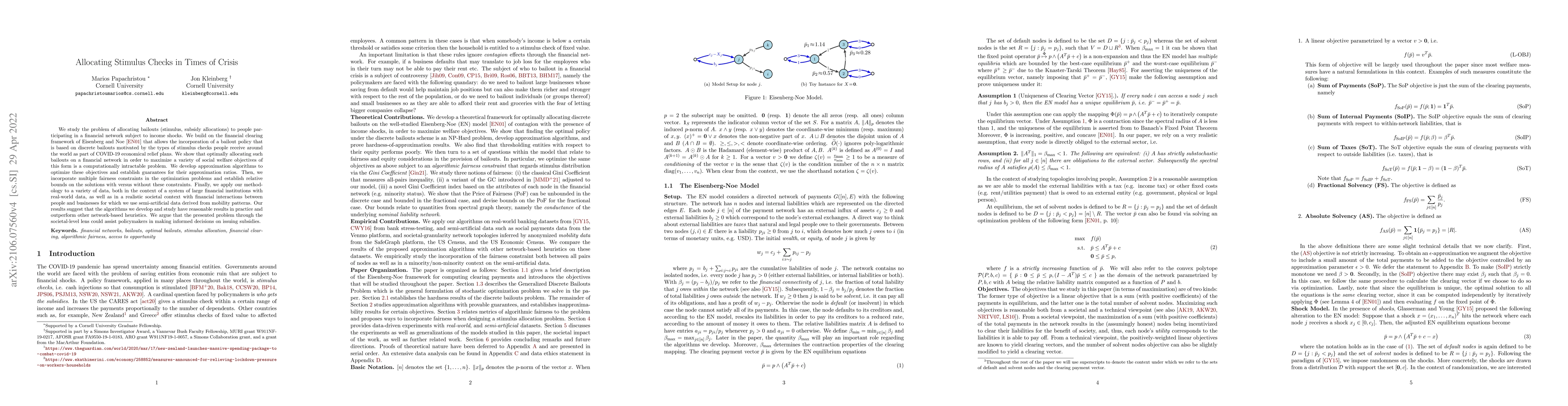

We study the problem of allocating bailouts (stimulus, subsidy allocations) to people participating in a financial network subject to income shocks. We build on the financial clearing framework of Eisenberg and Noe that allows the incorporation of a bailout policy that is based on discrete bailouts motivated by the types of stimulus checks people receive around the world as part of COVID-19 economical relief plans. We show that optimally allocating such bailouts on a financial network in order to maximize a variety of social welfare objectives of this form is a computationally intractable problem. We develop approximation algorithms to optimize these objectives and establish guarantees for their approximation rations. Then, we incorporate multiple fairness constraints in the optimization problems and establish relative bounds on the solutions with versus without these constraints. Finally, we apply our methodology to a variety of data, both in the context of a system of large financial institutions with real-world data, as well as in a realistic societal context with financial interactions between people and businesses for which we use semi-artificial data derived from mobility patterns. Our results suggest that the algorithms we develop and study have reasonable results in practice and outperform other network-based heuristics. We argue that the presented problem through the societal-level lens could assist policymakers in making informed decisions on issuing subsidies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal allocations to heterogeneous agents with an application to stimulus checks

Fan Wang, Vegard M. Nygaard, Bent E. Sørensen

Collective behavior of stock prices in the time of crisis as a response to the external stimulus

Holger Kantz, Philipp Meyer, Maryam Zamani et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)