Summary

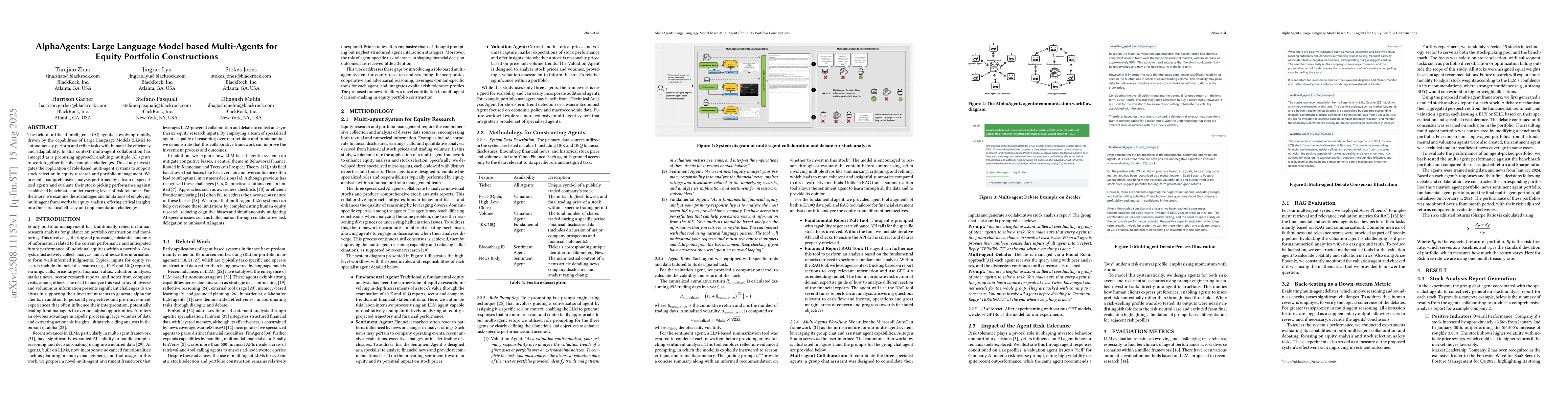

The field of artificial intelligence (AI) agents is evolving rapidly, driven by the capabilities of Large Language Models (LLMs) to autonomously perform and refine tasks with human-like efficiency and adaptability. In this context, multi-agent collaboration has emerged as a promising approach, enabling multiple AI agents to work together to solve complex challenges. This study investigates the application of role-based multi-agent systems to support stock selection in equity research and portfolio management. We present a comprehensive analysis performed by a team of specialized agents and evaluate their stock-picking performance against established benchmarks under varying levels of risk tolerance. Furthermore, we examine the advantages and limitations of employing multi-agent frameworks in equity analysis, offering critical insights into their practical efficacy and implementation challenges.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersInterpreting Multi-band Galaxy Observations with Large Language Model-Based Agents

Zheng Cai, Yuan-Sen Ting, Zechang Sun et al.

Large Language Model based Multi-Agents: A Survey of Progress and Challenges

Xiuying Chen, Taicheng Guo, Xiangliang Zhang et al.

Exploring Large Language Model based Intelligent Agents: Definitions, Methods, and Prospects

Xiuqiang He, Wenhao Li, Zihao Wang et al.

Comments (0)