Stefano Pasquali

25 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Towards reducing hallucination in extracting information from financial reports using Large Language Models

For a financial analyst, the question and answer (Q\&A) segment of the company financial report is a crucial piece of information for various analysis and investment decisions. However, extracting v...

Company Similarity using Large Language Models

Identifying companies with similar profiles is a core task in finance with a wide range of applications in portfolio construction, asset pricing and risk attribution. When a rigorous definition of s...

Quantifying Outlierness of Funds from their Categories using Supervised Similarity

Mutual fund categorization has become a standard tool for the investment management industry and is extensively used by allocators for portfolio construction and manager selection, as well as by fun...

Analytical Study of a generalised Dirichlet-Neumann operator and application to three-dimensional water waves on Beltrami flows

In this paper we consider three-dimensional steady water waves with vorticity, under the action of gravity and surface tension; in particular we consider so-called Beltrami flows, for which the velo...

Domain Specialization as the Key to Make Large Language Models Disruptive: A Comprehensive Survey

Large language models (LLMs) have significantly advanced the field of natural language processing (NLP), providing a highly useful, task-agnostic foundation for a wide range of applications. However...

Energy cascade for the Klein-Gordon lattice

We study analytically the dynamics of a $d$-dimensional Klein-Gordon lattice with periodic boundary conditions, for $d \leq 3$. We consider initial data supported on one low-frequency Fourier mode. ...

Learning Embedded Representation of the Stock Correlation Matrix using Graph Machine Learning

Understanding non-linear relationships among financial instruments has various applications in investment processes ranging from risk management, portfolio construction and trading strategies. Here,...

Learning Mutual Fund Categorization using Natural Language Processing

Categorization of mutual funds or Exchange-Traded-funds (ETFs) have long served the financial analysts to perform peer analysis for various purposes starting from competitor analysis, to quantifying...

Supervised similarity learning for corporate bonds using Random Forest proximities

Financial literature consists of ample research on similarity and comparison of financial assets and securities such as stocks, bonds, mutual funds, etc. However, going beyond correlations or aggreg...

Open Set Recognition for Random Forest

In many real-world classification or recognition tasks, it is often difficult to collect training examples that exhaust all possible classes due to, for example, incomplete knowledge during training o...

Can an unsupervised clustering algorithm reproduce a categorization system?

Peer analysis is a critical component of investment management, often relying on expert-provided categorization systems. These systems' consistency is questioned when they do not align with cohorts fr...

Case-based Explainability for Random Forest: Prototypes, Critics, Counter-factuals and Semi-factuals

The explainability of black-box machine learning algorithms, commonly known as Explainable Artificial Intelligence (XAI), has become crucial for financial and other regulated industrial applications d...

HybridRAG: Integrating Knowledge Graphs and Vector Retrieval Augmented Generation for Efficient Information Extraction

Extraction and interpretation of intricate information from unstructured text data arising in financial applications, such as earnings call transcripts, present substantial challenges to large languag...

A Comparative Study of DSPy Teleprompter Algorithms for Aligning Large Language Models Evaluation Metrics to Human Evaluation

We argue that the Declarative Self-improving Python (DSPy) optimizers are a way to align the large language model (LLM) prompts and their evaluations to the human annotations. We present a comparative...

How to Choose a Threshold for an Evaluation Metric for Large Language Models

To ensure and monitor large language models (LLMs) reliably, various evaluation metrics have been proposed in the literature. However, there is little research on prescribing a methodology to identify...

Supervised Similarity for High-Yield Corporate Bonds with Quantum Cognition Machine Learning

We investigate the application of quantum cognition machine learning (QCML), a novel paradigm for both supervised and unsupervised learning tasks rooted in the mathematical formalism of quantum theory...

Supervised Similarity for Firm Linkages

We introduce a novel proxy for firm linkages, Characteristic Vector Linkages (CVLs). We use this concept to estimate firm linkages, first through Euclidean similarity, and then by applying Quantum Cog...

AlphaAgents: Large Language Model based Multi-Agents for Equity Portfolio Constructions

The field of artificial intelligence (AI) agents is evolving rapidly, driven by the capabilities of Large Language Models (LLMs) to autonomously perform and refine tasks with human-like efficiency and...

Tracing Positional Bias in Financial Decision-Making: Mechanistic Insights from Qwen2.5

The growing adoption of large language models (LLMs) in finance exposes high-stakes decision-making to subtle, underexamined positional biases. The complexity and opacity of modern model architectures...

FinReflectKG: Agentic Construction and Evaluation of Financial Knowledge Graphs

The financial domain poses unique challenges for knowledge graph (KG) construction at scale due to the complexity and regulatory nature of financial documents. Despite the critical importance of struc...

FINCH: Financial Intelligence using Natural language for Contextualized SQL Handling

Text-to-SQL, the task of translating natural language questions into SQL queries, has long been a central challenge in NLP. While progress has been significant, applying it to the financial domain rem...

FinReflectKG -- MultiHop: Financial QA Benchmark for Reasoning with Knowledge Graph Evidence

Multi-hop reasoning over financial disclosures is often a retrieval problem before it becomes a reasoning or generation problem: relevant facts are dispersed across sections, filings, companies, and y...

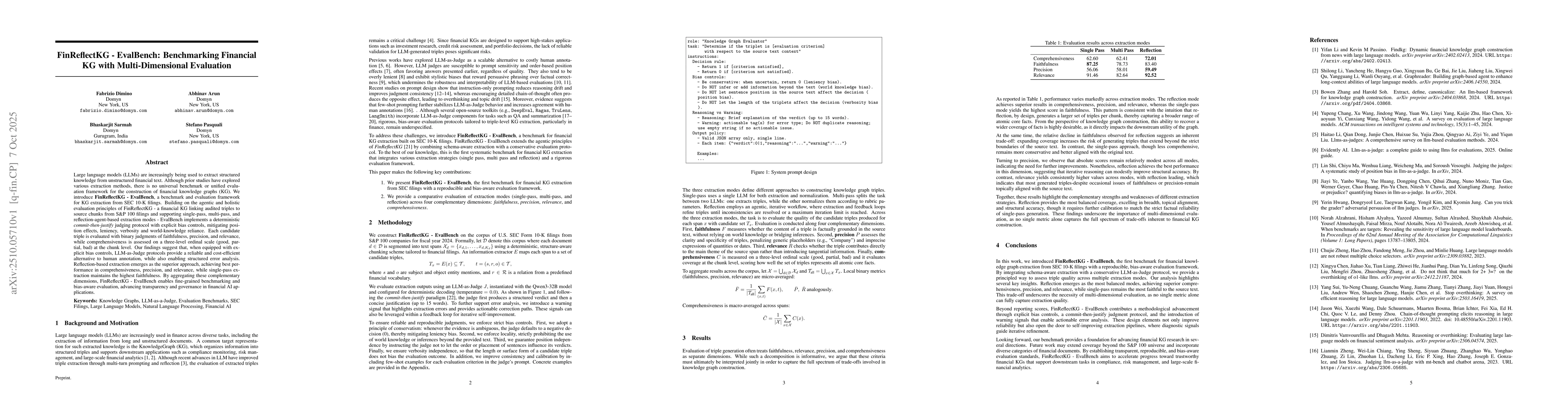

FinReflectKG - EvalBench: Benchmarking Financial KG with Multi-Dimensional Evaluation

Large language models (LLMs) are increasingly being used to extract structured knowledge from unstructured financial text. Although prior studies have explored various extraction methods, there is no ...

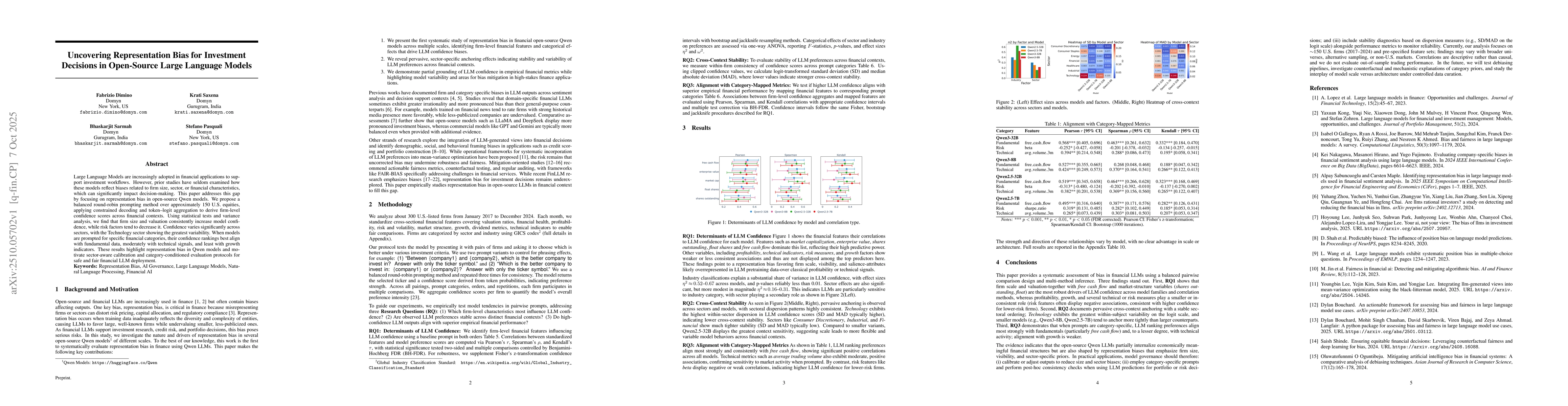

Uncovering Representation Bias for Investment Decisions in Open-Source Large Language Models

Large Language Models are increasingly adopted in financial applications to support investment workflows. However, prior studies have seldom examined how these models reflect biases related to firm si...

FinCARE: Financial Causal Analysis with Reasoning and Evidence

Portfolio managers rely on correlation-based analysis and heuristic methods that fail to capture true causal relationships driving performance. We present a hybrid framework that integrates statistica...