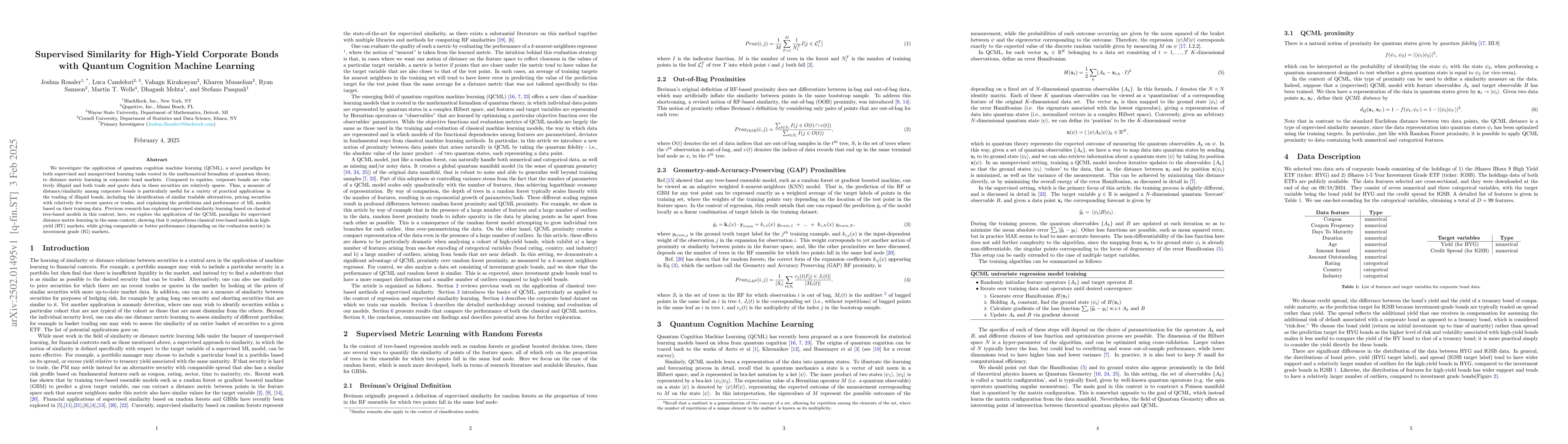

Summary

We investigate the application of quantum cognition machine learning (QCML), a novel paradigm for both supervised and unsupervised learning tasks rooted in the mathematical formalism of quantum theory, to distance metric learning in corporate bond markets. Compared to equities, corporate bonds are relatively illiquid and both trade and quote data in these securities are relatively sparse. Thus, a measure of distance/similarity among corporate bonds is particularly useful for a variety of practical applications in the trading of illiquid bonds, including the identification of similar tradable alternatives, pricing securities with relatively few recent quotes or trades, and explaining the predictions and performance of ML models based on their training data. Previous research has explored supervised similarity learning based on classical tree-based models in this context; here, we explore the application of the QCML paradigm for supervised distance metric learning in the same context, showing that it outperforms classical tree-based models in high-yield (HY) markets, while giving comparable or better performance (depending on the evaluation metric) in investment grade (IG) markets.

AI Key Findings

Generated Jun 12, 2025

Methodology

The research applies quantum cognition machine learning (QCML) to supervised distance metric learning in corporate bond markets, comparing its performance to classical tree-based models.

Key Results

- QCML outperforms classical tree-based models in high-yield (HY) markets.

- QCML provides comparable or better performance in investment grade (IG) markets, depending on the evaluation metric.

Significance

This research is important as it introduces QCML for distance metric learning in illiquid corporate bond markets, offering practical applications such as identifying similar tradable alternatives, pricing securities with sparse data, and explaining ML model predictions.

Technical Contribution

The novel application of QCML to supervised distance metric learning in corporate bond markets, demonstrating its superiority over classical tree-based models in certain contexts.

Novelty

This work differs from existing research by employing QCML, a quantum-inspired machine learning paradigm, for supervised similarity learning in corporate bond markets, showcasing its advantages over classical tree-based models.

Limitations

- The study focuses on high-yield and investment-grade corporate bonds, so generalizability to other bond categories might be limited.

- Performance comparisons are based on specific evaluation metrics, which may vary depending on the practical application.

Future Work

- Explore QCML applications in other fixed-income instruments or asset classes.

- Investigate the impact of varying data sparsity levels on QCML performance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersSupervised similarity learning for corporate bonds using Random Forest proximities

Dhruv Desai, Philip Sommer, Dhagash Mehta et al.

The VIX as Stochastic Volatility for Corporate Bonds

Andrey Sarantsev, Jihyun Park

No citations found for this paper.

Comments (0)