Summary

Large language models (LLMs) are increasingly being used to extract structured knowledge from unstructured financial text. Although prior studies have explored various extraction methods, there is no universal benchmark or unified evaluation framework for the construction of financial knowledge graphs (KG). We introduce FinReflectKG - EvalBench, a benchmark and evaluation framework for KG extraction from SEC 10-K filings. Building on the agentic and holistic evaluation principles of FinReflectKG - a financial KG linking audited triples to source chunks from S&P 100 filings and supporting single-pass, multi-pass, and reflection-agent-based extraction modes - EvalBench implements a deterministic commit-then-justify judging protocol with explicit bias controls, mitigating position effects, leniency, verbosity and world-knowledge reliance. Each candidate triple is evaluated with binary judgments of faithfulness, precision, and relevance, while comprehensiveness is assessed on a three-level ordinal scale (good, partial, bad) at the chunk level. Our findings suggest that, when equipped with explicit bias controls, LLM-as-Judge protocols provide a reliable and cost-efficient alternative to human annotation, while also enabling structured error analysis. Reflection-based extraction emerges as the superior approach, achieving best performance in comprehensiveness, precision, and relevance, while single-pass extraction maintains the highest faithfulness. By aggregating these complementary dimensions, FinReflectKG - EvalBench enables fine-grained benchmarking and bias-aware evaluation, advancing transparency and governance in financial AI applications.

AI Key Findings

Generated Oct 09, 2025

Methodology

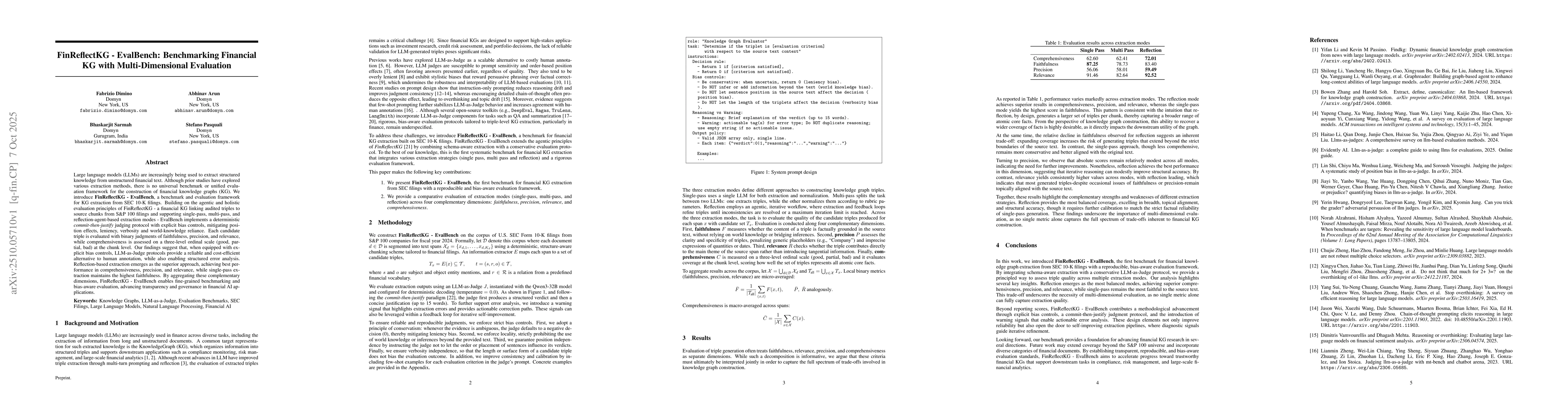

The research introduces FinReflectKG-EvalBench, a benchmark for financial KG extraction from SEC 10-K filings. It combines schema-aware extraction with a conservative LLM-as-Judge protocol, using deterministic decoding and explicit bias controls to evaluate triples across four dimensions: faithfulness, precision, relevance, and comprehensiveness.

Key Results

- Reflection-based extraction achieves the best performance in comprehensiveness, precision, and relevance.

- Single-pass extraction maintains the highest faithfulness but is less comprehensive.

- LLM-as-Judge protocols with explicit bias controls provide reliable and cost-efficient evaluation comparable to human annotation.

Significance

This research advances transparency and governance in financial AI by providing a multi-dimensional benchmark for evaluating KG extraction, enabling structured error analysis and improving the reliability of LLM-generated financial knowledge.

Technical Contribution

The paper introduces FinReflectKG-EvalBench, the first systematic benchmark for financial KG extraction that integrates multiple extraction strategies and a rigorous evaluation framework with bias controls.

Novelty

The work introduces a commit-then-justify judging protocol with explicit bias controls, along with a multi-dimensional evaluation framework that enables fine-grained benchmarking and bias-aware evaluation of financial KG extraction.

Limitations

- The benchmark is limited to SEC 10-K filings from S&P 100 companies, which may not represent the full financial document landscape.

- The evaluation framework focuses on structured triples but may not fully capture the complexity of real-world financial knowledge representation.

Future Work

- Extend coverage beyond S&P 100 companies to include a broader range of financial documents.

- Incorporate diverse financial document types to enhance the benchmark's applicability.

- Develop automated feedback mechanisms for continuous improvement of extraction pipelines.

Paper Details

PDF Preview

Similar Papers

Found 4 papersFinMME: Benchmark Dataset for Financial Multi-Modal Reasoning Evaluation

Yike Guo, Ming Zhang, Xiao Luo et al.

Comments (0)