Fabrizio Dimino

5 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

RiskLabs: Predicting Financial Risk Using Large Language Model Based on Multi-Sources Data

The integration of Artificial Intelligence (AI) techniques, particularly large language models (LLMs), in finance has garnered increasing academic attention. Despite progress, existing studies predo...

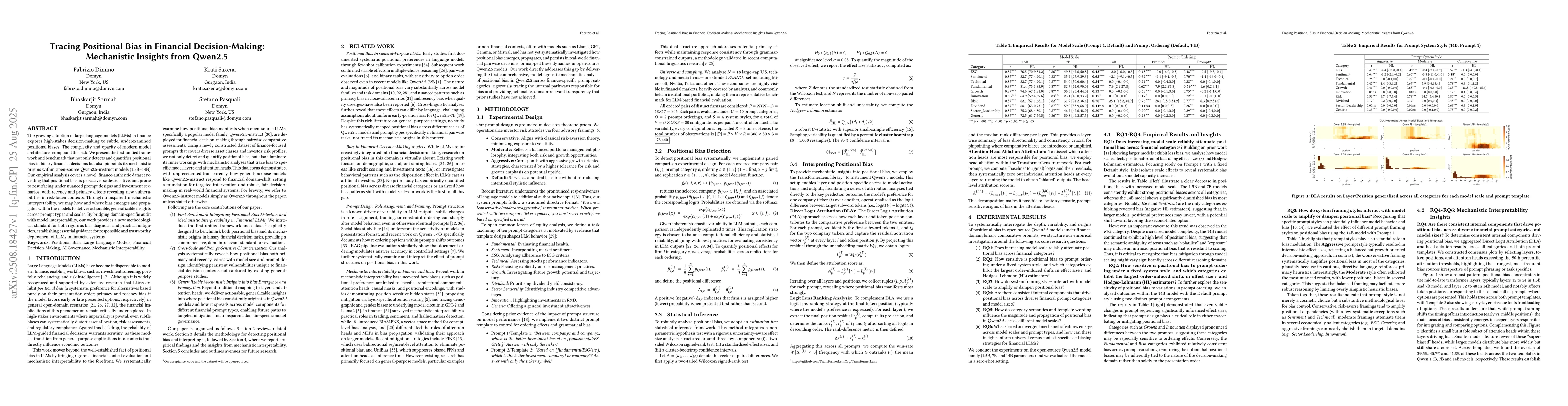

Tracing Positional Bias in Financial Decision-Making: Mechanistic Insights from Qwen2.5

The growing adoption of large language models (LLMs) in finance exposes high-stakes decision-making to subtle, underexamined positional biases. The complexity and opacity of modern model architectures...

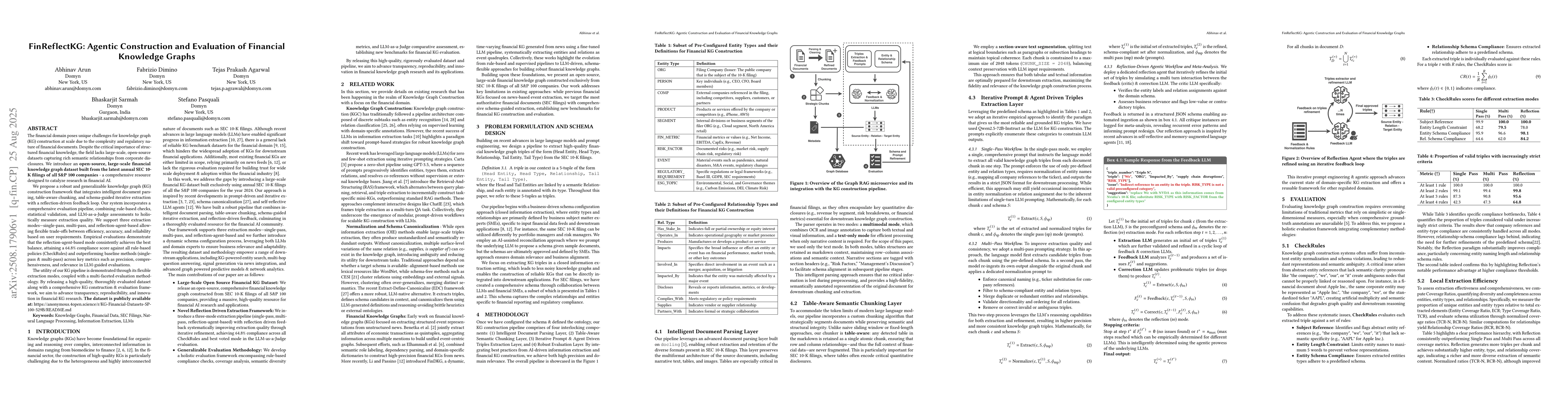

FinReflectKG: Agentic Construction and Evaluation of Financial Knowledge Graphs

The financial domain poses unique challenges for knowledge graph (KG) construction at scale due to the complexity and regulatory nature of financial documents. Despite the critical importance of struc...

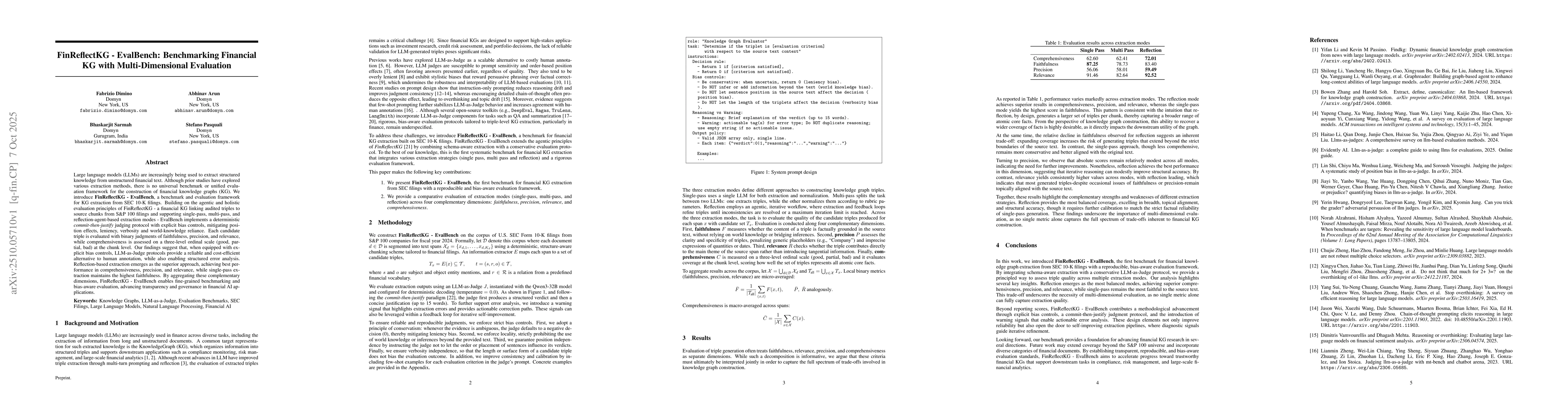

FinReflectKG - EvalBench: Benchmarking Financial KG with Multi-Dimensional Evaluation

Large language models (LLMs) are increasingly being used to extract structured knowledge from unstructured financial text. Although prior studies have explored various extraction methods, there is no ...

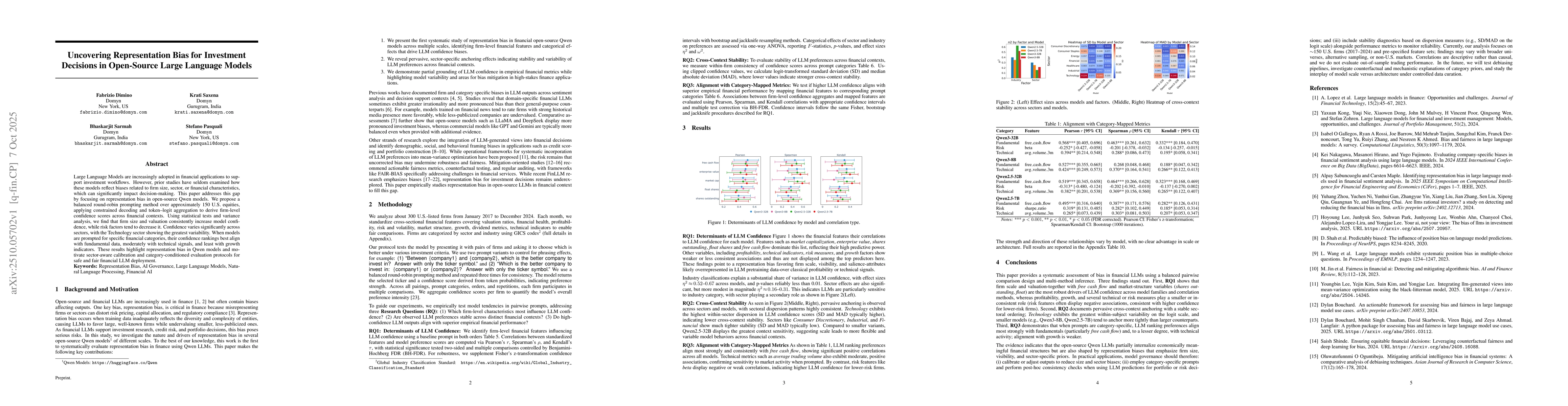

Uncovering Representation Bias for Investment Decisions in Open-Source Large Language Models

Large Language Models are increasingly adopted in financial applications to support investment workflows. However, prior studies have seldom examined how these models reflect biases related to firm si...