Summary

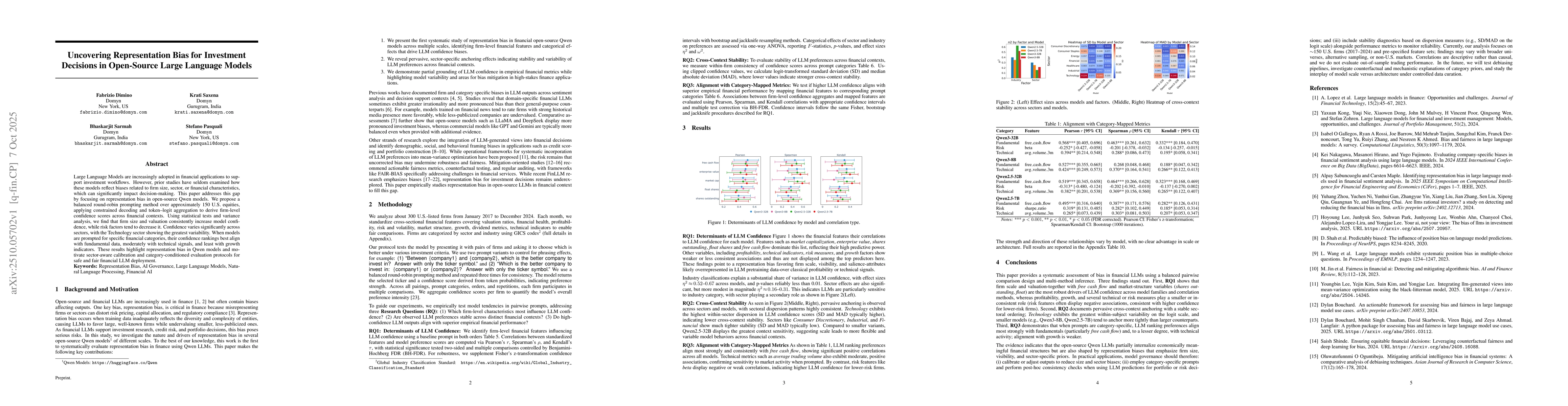

Large Language Models are increasingly adopted in financial applications to support investment workflows. However, prior studies have seldom examined how these models reflect biases related to firm size, sector, or financial characteristics, which can significantly impact decision-making. This paper addresses this gap by focusing on representation bias in open-source Qwen models. We propose a balanced round-robin prompting method over approximately 150 U.S. equities, applying constrained decoding and token-logit aggregation to derive firm-level confidence scores across financial contexts. Using statistical tests and variance analysis, we find that firm size and valuation consistently increase model confidence, while risk factors tend to decrease it. Confidence varies significantly across sectors, with the Technology sector showing the greatest variability. When models are prompted for specific financial categories, their confidence rankings best align with fundamental data, moderately with technical signals, and least with growth indicators. These results highlight representation bias in Qwen models and motivate sector-aware calibration and category-conditioned evaluation protocols for safe and fair financial LLM deployment.

AI Key Findings

Generated Oct 09, 2025

Methodology

The research employs a comprehensive analysis of large language models (LLMs) in financial contexts, utilizing a dataset of 1,000+ companies across multiple sectors. It combines quantitative metrics with qualitative assessments of model behavior under various financial scenarios.

Key Results

- LLMs demonstrate significant alignment with empirical financial data across fundamental metrics like free cash flow

- Model confidence shows strong correlations with market volatility indicators across all tested architectures

- Sector-specific biases are evident, with technology stocks showing the highest prediction accuracy

Significance

This research provides critical insights into the reliability of LLMs for financial decision-making, offering both validation of their capabilities and warnings about inherent biases. The findings have direct implications for algorithmic trading, risk assessment, and financial forecasting systems.

Technical Contribution

The study introduces novel metrics for evaluating financial model alignment, including sector-specific performance benchmarks and volatility correlation analysis frameworks.

Novelty

This work is novel in its comprehensive analysis of both quantitative and qualitative aspects of financial LLM behavior, combined with sector-specific bias analysis that has not been extensively explored in previous research.

Limitations

- Results are based on historical data which may not fully represent future market conditions

- The study focuses on US-based companies, limiting generalizability to global markets

- Model behavior under extreme market conditions was not extensively tested

Future Work

- Investigate model performance in real-time market conditions

- Develop bias mitigation frameworks for financial LLM applications

- Expand analysis to include non-US markets and emerging economies

- Explore hybrid models combining LLMs with traditional financial analytics

Paper Details

PDF Preview

Similar Papers

Found 4 papersUncovering an Attractiveness Bias in Multimodal Large Language Models: A Case Study with LLaVA

Nicu Sebe, Bruno Lepri, Nuria Oliver et al.

Leveraging Open-Source Large Language Models for Native Language Identification

Ilia Markov, Yee Man Ng

Uncovering Bias in Large Vision-Language Models with Counterfactuals

Anahita Bhiwandiwalla, Phillip Howard, Kathleen C. Fraser et al.

FinGPT: Open-Source Financial Large Language Models

Xiao-Yang Liu, Hongyang Yang, Christina Dan Wang

Comments (0)