Summary

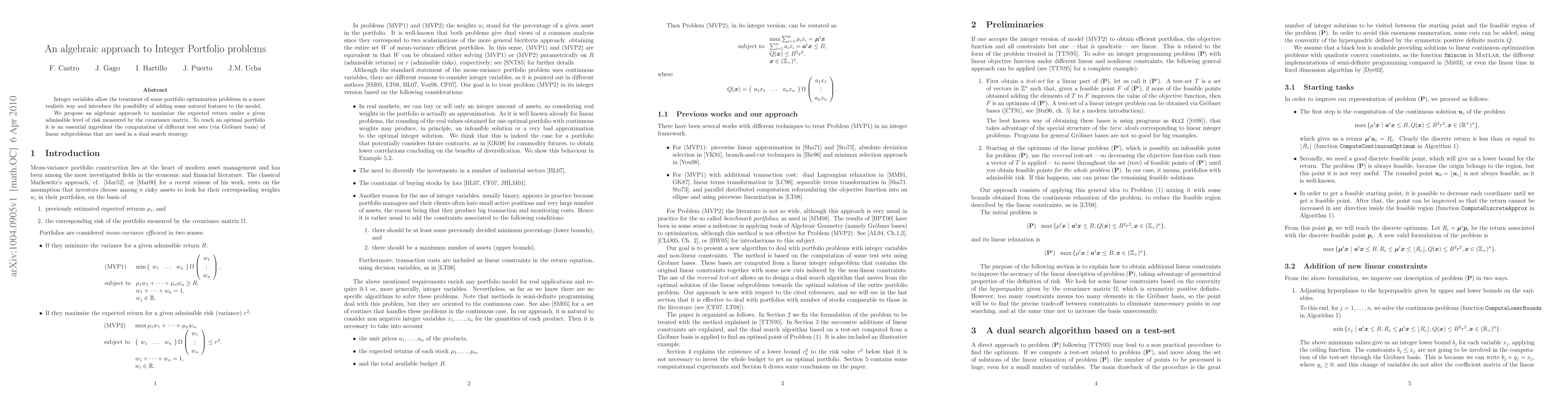

Integer variables allow the treatment of some portfolio optimization problems in a more realistic way and introduce the possibility of adding some natural features to the model. We propose an algebraic approach to maximize the expected return under a given admissible level of risk measured by the covariance matrix. To reach an optimal portfolio it is an essential ingredient the computation of different test sets (via Gr\"obner basis) of linear subproblems that are used in a dual search strategy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)