Summary

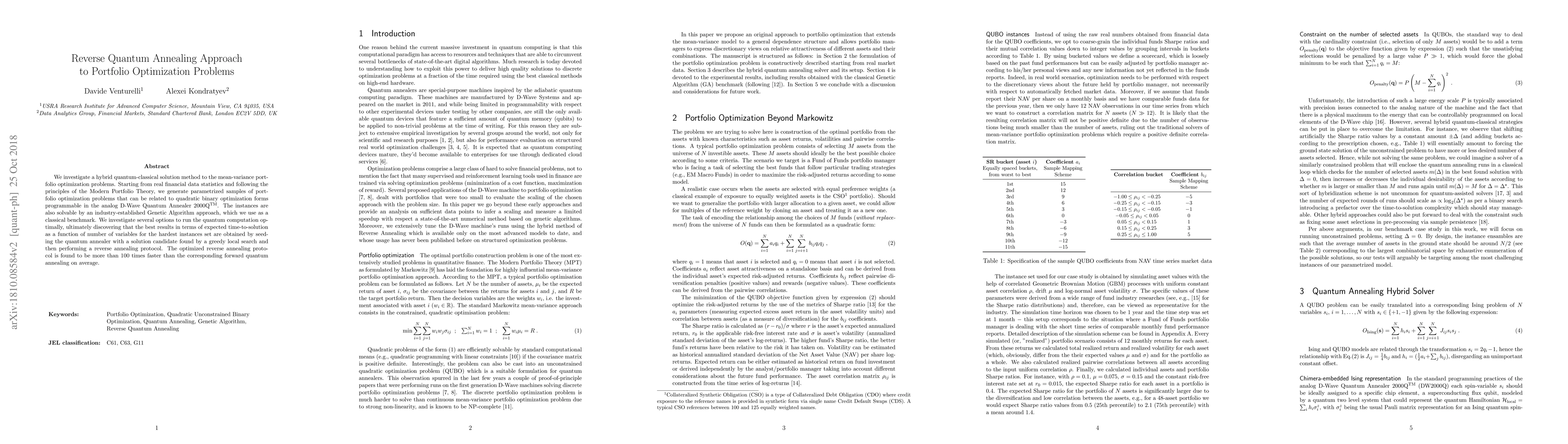

We investigate a hybrid quantum-classical solution method to the mean-variance portfolio optimization problems. Starting from real financial data statistics and following the principles of the Modern Portfolio Theory, we generate parametrized samples of portfolio optimization problems that can be related to quadratic binary optimization forms programmable in the analog D-Wave Quantum Annealer 2000Q. The instances are also solvable by an industry-established Genetic Algorithm approach, which we use as a classical benchmark. We investigate several options to run the quantum computation optimally, ultimately discovering that the best results in terms of expected time-to-solution as a function of number of variables for the hardest instances set are obtained by seeding the quantum annealer with a solution candidate found by a greedy local search and then performing a reverse annealing protocol. The optimized reverse annealing protocol is found to be more than 100 times faster than the corresponding forward quantum annealing on average.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersComparative analysis of diverse methodologies for portfolio optimization leveraging quantum annealing techniques

Arit Kumar Bishwas, Zhijie Tang, Alex Lu Dou

End-to-End Portfolio Optimization with Quantum Annealing

Kazuki Ikeda, Sai Nandan Morapakula, Sangram Deshpande et al.

Exploring the synergistic potential of quantum annealing and gate model computing for portfolio optimization

Naman Jain, M Girish Chandra

| Title | Authors | Year | Actions |

|---|

Comments (0)