Authors

Summary

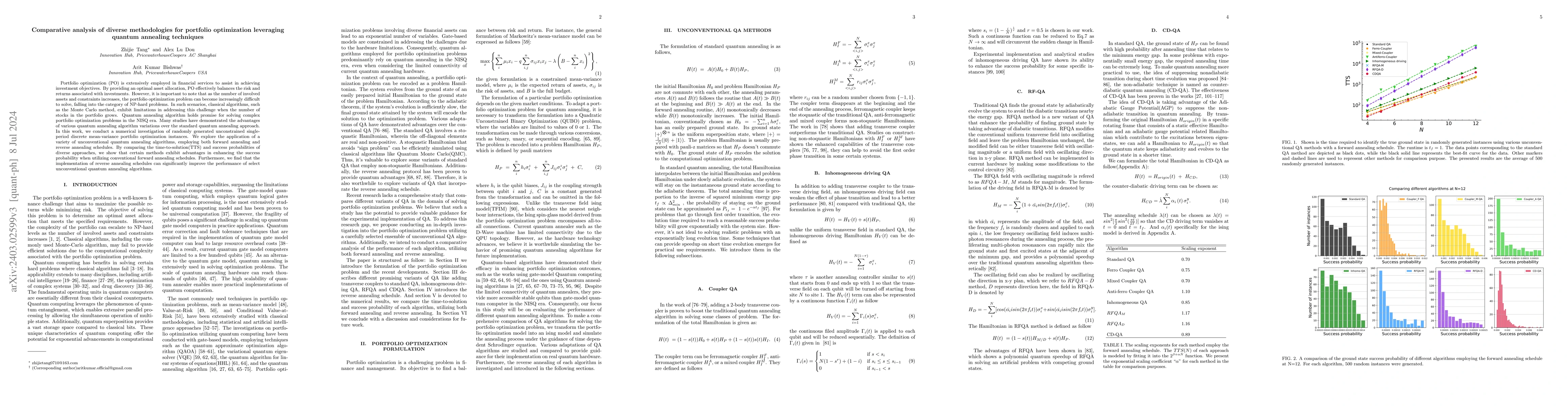

Portfolio optimization (PO) is extensively employed in financial services to assist in achieving investment objectives. By providing an optimal asset allocation, PO effectively balances the risk and returns associated with investments. However, it is important to note that as the number of involved assets and constraints increases, the portfolio optimization problem can become increasingly difficult to solve, falling into the category of NP-hard problems. In such scenarios, classical algorithms, such as the Monte Carlo method, exhibit limitations in addressing this challenge when the number of stocks in the portfolio grows. Quantum annealing algorithm holds promise for solving complex portfolio optimization problems in the NISQ era. Many studies have demonstrated the advantages of various quantum annealing algorithm variations over the standard quantum annealing approach. In this work, we conduct a numerical investigation of randomly generated unconstrained single-period discrete mean-variance portfolio optimization instances. We explore the application of a variety of unconventional quantum annealing algorithms, employing both forward annealing and reverse annealing schedules. By comparing the time-to-solution(TTS) and success probabilities of diverse approaches, we show that certain methods exhibit advantages in enhancing the success probability when utilizing conventional forward annealing schedules. Furthermore, we find that the implementation of reverse annealing schedules can significantly improve the performance of select unconventional quantum annealing algorithms.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnd-to-End Portfolio Optimization with Quantum Annealing

Kazuki Ikeda, Sai Nandan Morapakula, Sangram Deshpande et al.

Exploring the synergistic potential of quantum annealing and gate model computing for portfolio optimization

Naman Jain, M Girish Chandra

No citations found for this paper.

Comments (0)