Summary

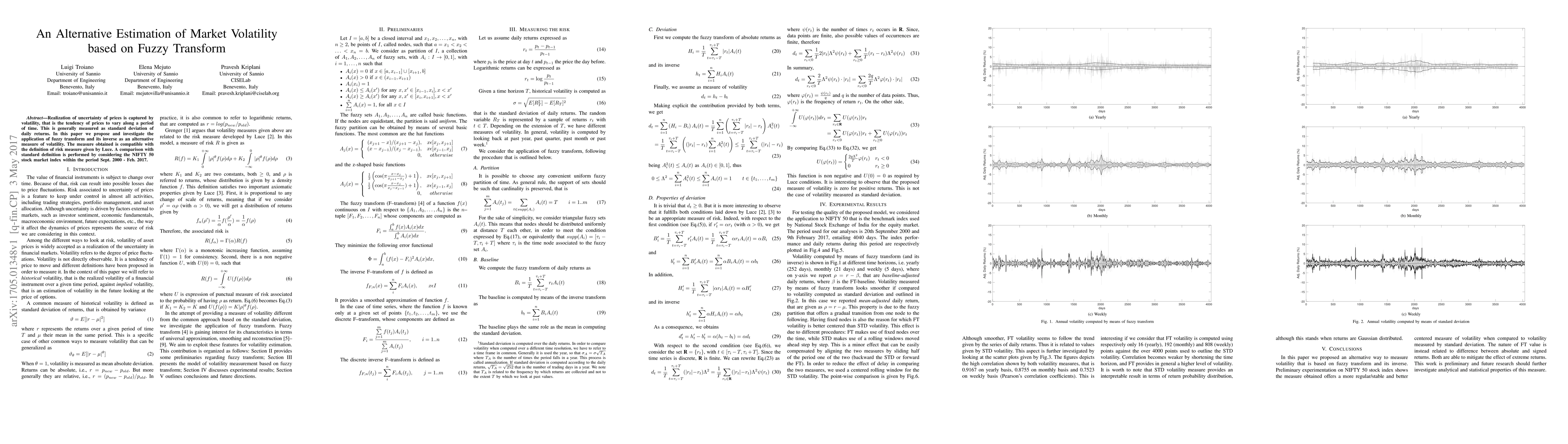

Realization of uncertainty of prices is captured by volatility, that is the tendency of prices to vary along a period of time. This is generally measured as standard deviation of daily returns. In this paper we propose and investigate the application of fuzzy transform and its inverse as an alternative measure of volatility. The measure obtained is compatible with the definition of risk measure given by Luce. A comparison with standard definition is performed by considering the NIFTY 50 stock market index within the period Sept. 2000 - Feb. 2017.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)