Summary

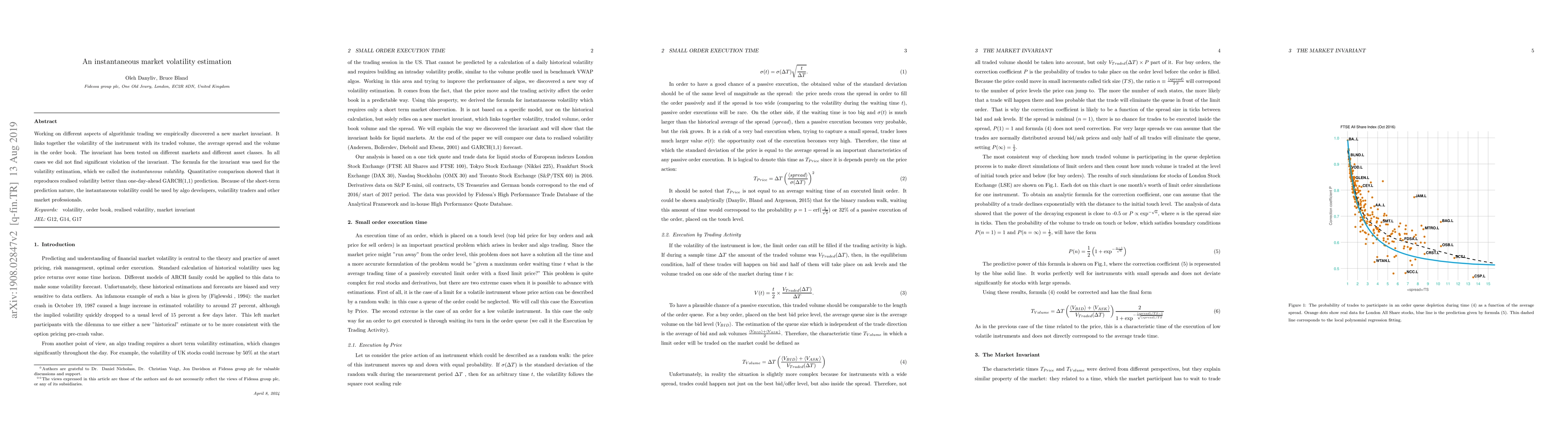

Working on different aspects of algorithmic trading we empirically discovered a new market invariant. It links together the volatility of the instrument with its traded volume, the average spread and the volume in the order book. The invariant has been tested on different markets and different asset classes. In all cases we did not find significant violation of the invariant. The formula for the invariant was used for the volatility estimation, which we called the instantaneous volatility. Quantitative comparison showed that it reproduces realised volatility better than one-day-ahead GARCH(1,1) prediction. Because of the short-term prediction nature, the instantaneous volatility could be used by algo developers, volatility traders and other market professionals.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPortfolio Volatility Estimation Relative to Stock Market Cross-Sectional Intrinsic Entropy

Marcel Ausloos, Claudiu Vinte

Matrix-based Prediction Approach for Intraday Instantaneous Volatility Vector

Donggyu Kim, Sung Hoon Choi

No citations found for this paper.

Comments (0)