Summary

This paper is concerned with the estimation of the volatility process in a stochastic volatility model of the following form: $dX_t=a_tdt+\sigma_tdW_t$, where $X$ denotes the log-price and $\sigma$ is a c\`adl\`ag semi-martingale. In the spirit of a series of recent works on the estimation of the cumulated volatility, we here focus on the instantaneous volatility for which we study estimators built as finite differences of the \textit{power variations} of the log-price. We provide central limit theorems with an optimal rate depending on the local behavior of $\sigma$. In particular, these theorems yield some confidence intervals for $\sigma_t$.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

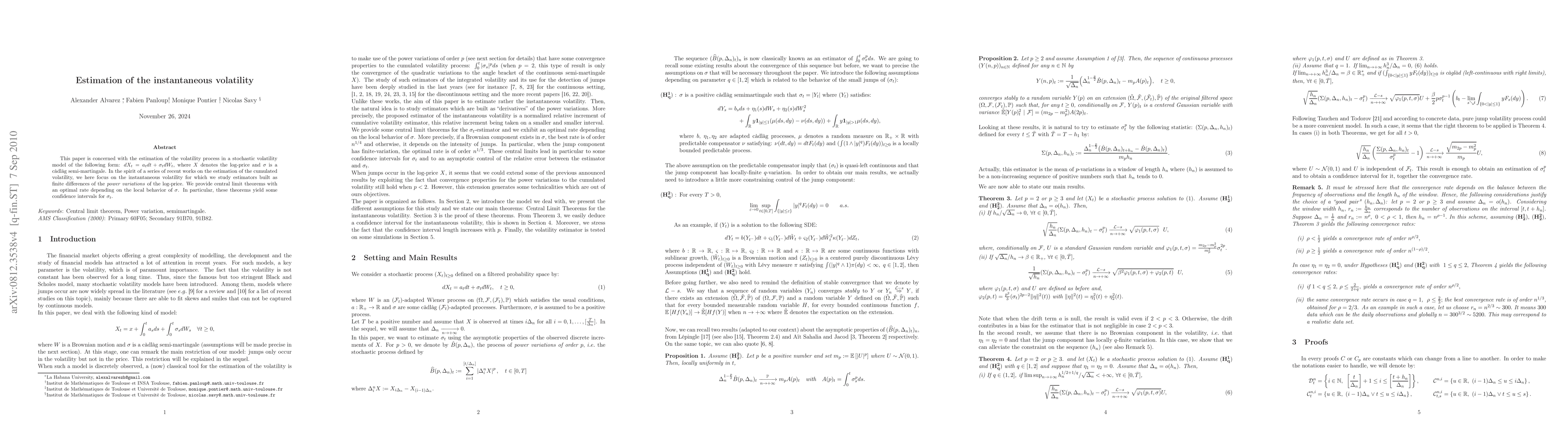

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLow-Rank Structured Nonparametric Prediction of Instantaneous Volatility

Donggyu Kim, Sung Hoon Choi

Matrix-based Prediction Approach for Intraday Instantaneous Volatility Vector

Donggyu Kim, Sung Hoon Choi

| Title | Authors | Year | Actions |

|---|

Comments (0)