Summary

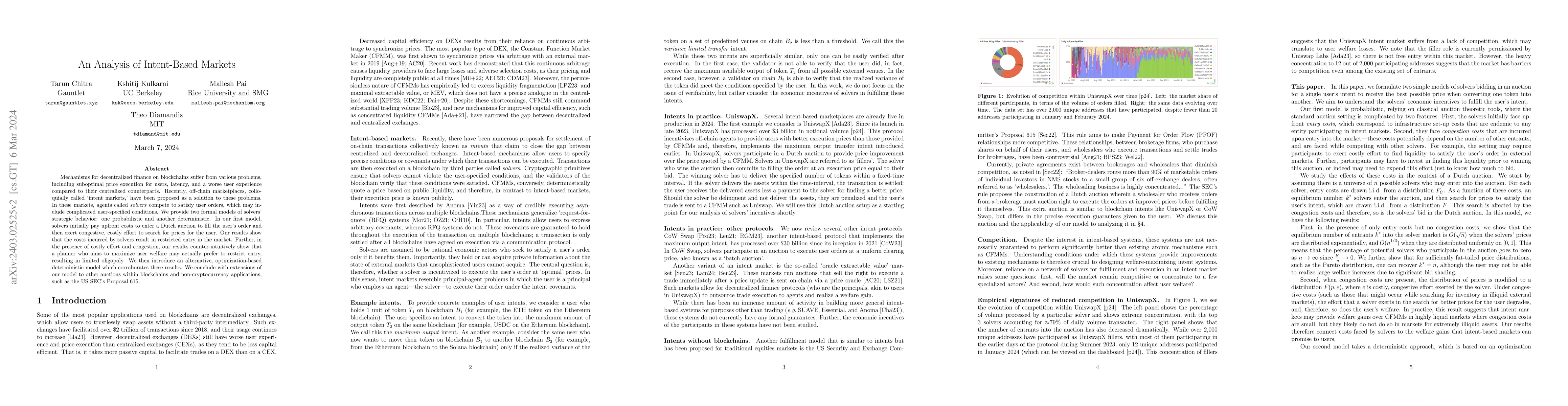

Mechanisms for decentralized finance on blockchains suffer from various problems, including suboptimal price execution for users, latency, and a worse user experience compared to their centralized counterparts. Recently, off-chain marketplaces, colloquially called `intent markets,' have been proposed as a solution to these problems. In these markets, agents called \emph{solvers} compete to satisfy user orders, which may include complicated user-specified conditions. We provide two formal models of solvers' strategic behavior: one probabilistic and another deterministic. In our first model, solvers initially pay upfront costs to enter a Dutch auction to fill the user's order and then exert congestive, costly effort to search for prices for the user. Our results show that the costs incurred by solvers result in restricted entry in the market. Further, in the presence of costly effort and congestion, our results counter-intuitively show that a planner who aims to maximize user welfare may actually prefer to restrict entry, resulting in limited oligopoly. We then introduce an alternative, optimization-based deterministic model which corroborates these results. We conclude with extensions of our model to other auctions within blockchains and non-cryptocurrency applications, such as the US SEC's Proposal 615.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersiServe: An Intent-based Serving System for LLMs

Tianrui Hu, Prasoon Sinha, Neeraja J. Yadwadkar et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)