Summary

Uniswap -- and other constant product markets -- appear to work well in practice despite their simplicity. In this paper, we give a simple formal analysis of constant product markets and their generalizations, showing that, under some common conditions, these markets must closely track the reference market price. We also show that Uniswap satisfies many other desirable properties and numerically demonstrate, via a large-scale agent-based simulation, that Uniswap is stable under a wide range of market conditions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

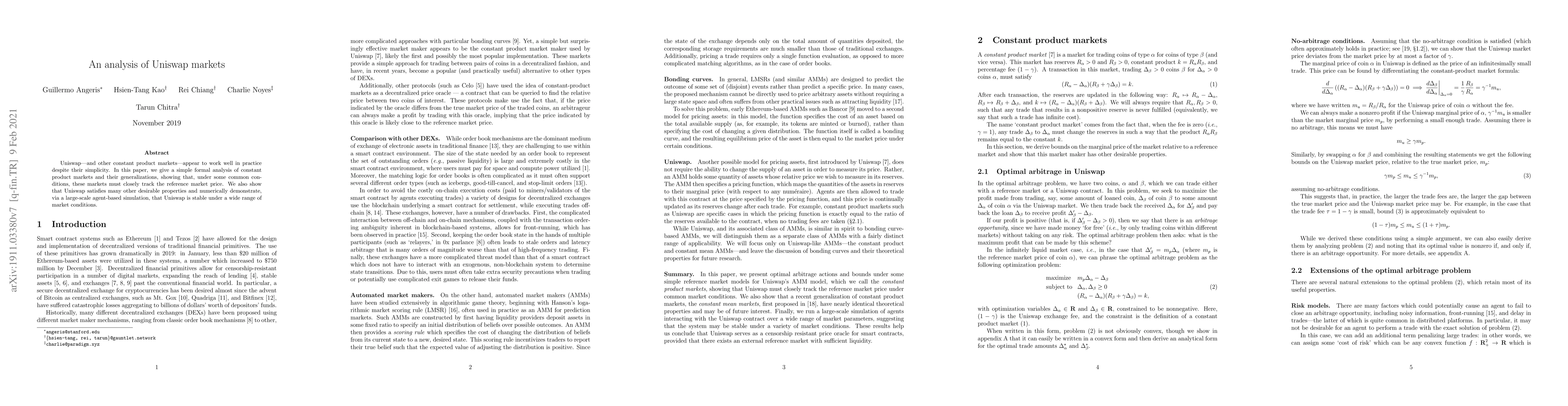

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Empirical Study of Market Inefficiencies in Uniswap and SushiSwap

Roger Wattenhofer, Lioba Heimbach, Robin Fritsch et al.

Network Analysis of Uniswap: Centralization and Fragility in the Decentralized Exchange Market

Tao Yan, Claudio J. Tessone

Exploring Price Accuracy on Uniswap V3 in Times of Distress

Roger Wattenhofer, Lioba Heimbach, Eric Schertenleib

Risks and Returns of Uniswap V3 Liquidity Providers

Roger Wattenhofer, Lioba Heimbach, Eric Schertenleib

| Title | Authors | Year | Actions |

|---|

Comments (0)