Authors

Summary

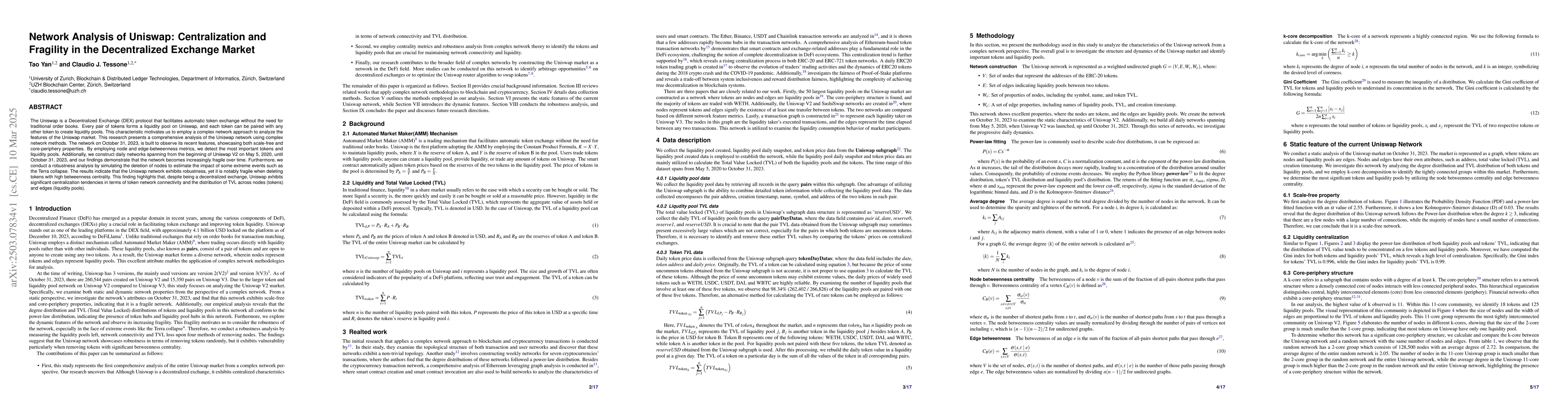

The Uniswap is a Decentralized Exchange (DEX) protocol that facilitates automatic token exchange without the need for traditional order books. Every pair of tokens forms a liquidity pool on Uniswap, and each token can be paired with any other token to create liquidity pools. This characteristic motivates us to employ a complex network approach to analyze the features of the Uniswap market. This research presents a comprehensive analysis of the Uniswap network using complex network methods. The network on October 31, 2023, is built to observe its recent features, showcasing both scale-free and core-periphery properties. By employing node and edge-betweenness metrics, we detect the most important tokens and liquidity pools. Additionally, we construct daily networks spanning from the beginning of Uniswap V2 on May 5, 2020, until October 31, 2023, and our findings demonstrate that the network becomes increasingly fragile over time. Furthermore, we conduct a robustness analysis by simulating the deletion of nodes to estimate the impact of some extreme events such as the Terra collapse. The results indicate that the Uniswap network exhibits robustness, yet it is notably fragile when deleting tokens with high betweenness centrality. This finding highlights that, despite being a decentralized exchange, Uniswap exhibits significant centralization tendencies in terms of token network connectivity and the distribution of TVL across nodes (tokens) and edges (liquidity pools).

AI Key Findings

Generated Jun 10, 2025

Methodology

This research employs complex network methods to analyze the Uniswap market, constructing daily networks from May 5, 2020, to October 31, 2023, using liquidity pool and token TVL data.

Key Results

- The Uniswap network exhibits scale-free properties and a core-periphery structure.

- The network becomes increasingly fragile over time, particularly vulnerable to the removal of nodes with high betweenness centrality.

- Robustness analysis shows that the network is robust against random node removal but fragile to targeted attacks based on betweenness centrality.

Significance

This study reveals centralization tendencies in Uniswap's decentralized exchange, highlighting its vulnerability to specific token collapses, which can significantly impact the overall market connectivity and TVL.

Technical Contribution

This paper presents a comprehensive network analysis of Uniswap V2, identifying its scale-free properties, core-periphery structure, and fragility over time.

Novelty

The research distinguishes itself by applying complex network methods to Uniswap, uncovering centralization tendencies and fragility in a decentralized exchange market, which was not previously extensively studied.

Limitations

- The analysis does not consider the impact of Uniswap V3 features introduced in May 2021.

- The research focuses on Uniswap V2 and does not explore potential differences in Uniswap V3's network properties.

Future Work

- Investigate the characteristics of Uniswap V3 network using similar analysis methods.

- Explore alternative metrics to assess token and liquidity pool importance within the network.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBacktesting Framework for Concentrated Liquidity Market Makers on Uniswap V3 Decentralized Exchange

Andrey Urusov, Rostislav Berezovskiy, Yury Yanovich

An Empirical Study of Market Inefficiencies in Uniswap and SushiSwap

Roger Wattenhofer, Lioba Heimbach, Robin Fritsch et al.

No citations found for this paper.

Comments (0)