Summary

An analysis of the Japanese credit market in 2004 between banks and quoted firms is done in this paper using the tools of the networks theory. It can be pointed out that: (i) a backbone of the credit channel emerges, where some links play a crucial role; (ii) big banks privilege long-term contracts; the "minimal spanning trees" (iii) disclose a highly hierarchical backbone, where the central positions are occupied by the largest banks, and emphasize (iv) a strong geographical characterization, while (v) the clusters of firms do not have specific common properties. Moreover, (vi) while larger firms have multiple lending in large, (vii) the demand for credit (long vs. short term debt and multi-credit lines) of firms with similar sizes is very heterogeneous.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

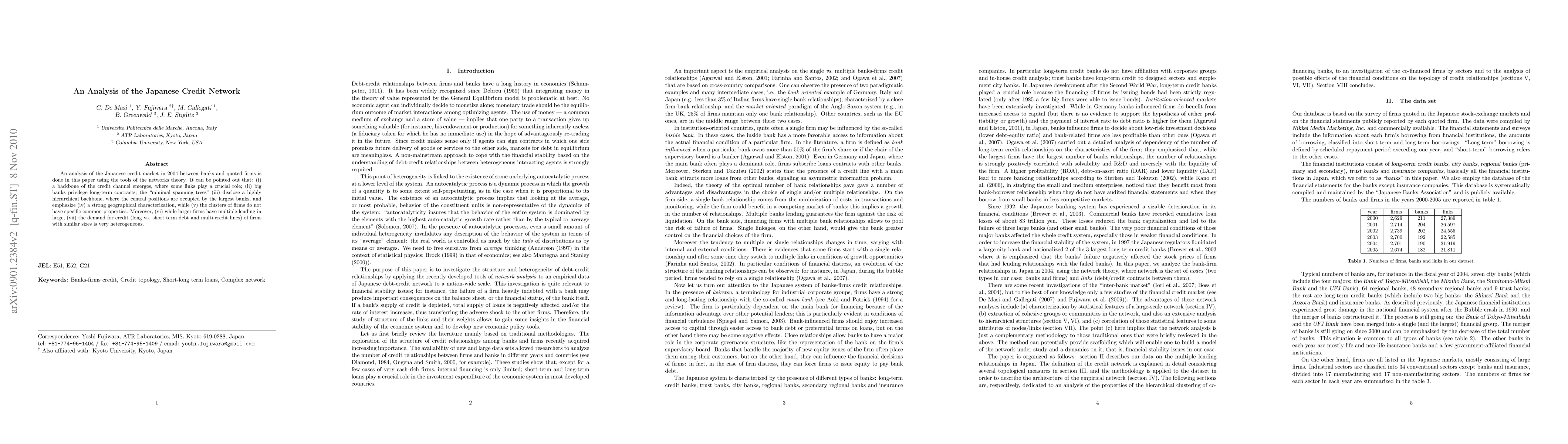

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)