Summary

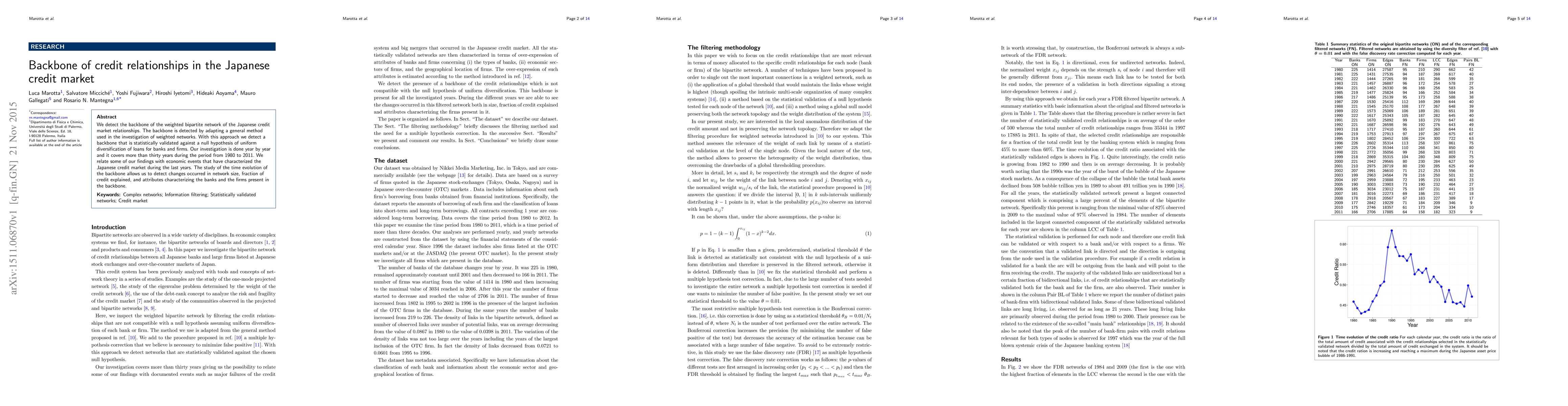

We detect the backbone of the weighted bipartite network of the Japanese credit market relationships. The backbone is detected by adapting a general method used in the investigation of weighted networks. With this approach we detect a backbone that is statistically validated against a null hypothesis of uniform diversification of loans for banks and firms. Our investigation is done year by year and it covers more than thirty years during the period from 1980 to 2011. We relate some of our findings with economic events that have characterized the Japanese credit market during the last years. The study of the time evolution of the backbone allows us to detect changes occurred in network size, fraction of credit explained, and attributes characterizing the banks and the firms present in the backbone.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)