Summary

Constant-function market makers (CFMMs), such as Uniswap, are automated exchanges offering trades among a set of assets. We study their technical relationship to another class of automated market makers, cost-function prediction markets. We first introduce axioms for market makers and show that CFMMs with concave potential functions characterize "good" market makers according to these axioms. We then show that every such CFMM on $n$ assets is equivalent to a cost-function prediction market for events with $n$ outcomes. Our construction directly converts a CFMM into a prediction market and vice versa. Conceptually, our results show that desirable market-making axioms are equivalent to desirable information-elicitation axioms, i.e., markets are good at facilitating trade if and only if they are good at revealing beliefs. For example, we show that every CFMM implicitly defines a proper scoring rule for eliciting beliefs; the scoring rule for Uniswap is unusual, but known. From a technical standpoint, our results show how tools for prediction markets and CFMMs can interoperate. We illustrate this interoperability by showing how liquidity strategies from both literatures transfer to the other, yielding new market designs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

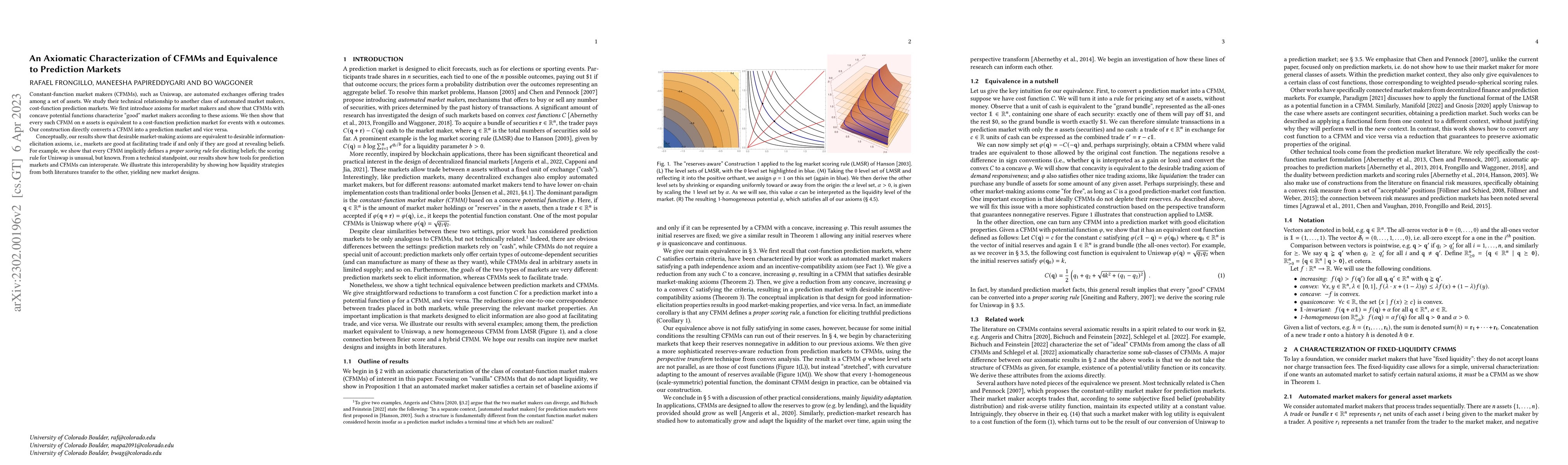

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)