Summary

Prediction markets are well-studied in the case where predictions are probabilities or expectations of future random variables. In 2008, Lambert, et al. proposed a generalization, which we call "scoring rule markets" (SRMs), in which traders predict the value of arbitrary statistics of the random variables, provided these statistics can be elicited by a scoring rule. Surprisingly, despite active recent work on prediction markets, there has not yet been any investigation into the properties of more general SRMs. To initiate such a study, we ask the following question: in what sense are SRMs "markets"? We classify SRMs according to several axioms that capture potentially desirable qualities of a market, such as the ability to freely exchange goods (contracts) for money. Not all SRMs satisfy our axioms: once a contract is purchased in any market for prediction the median of some variable, there will not necessarily be any way to sell that contract back, even in a very weak sense. Our main result is a characterization showing that slight generalizations of cost-function-based markets are the only markets to satisfy all of our axioms for finite-outcome random variables. Nonetheless, we find that several SRMs satisfy weaker versions of our axioms, including a novel share-based market mechanism for ratios of expected values.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

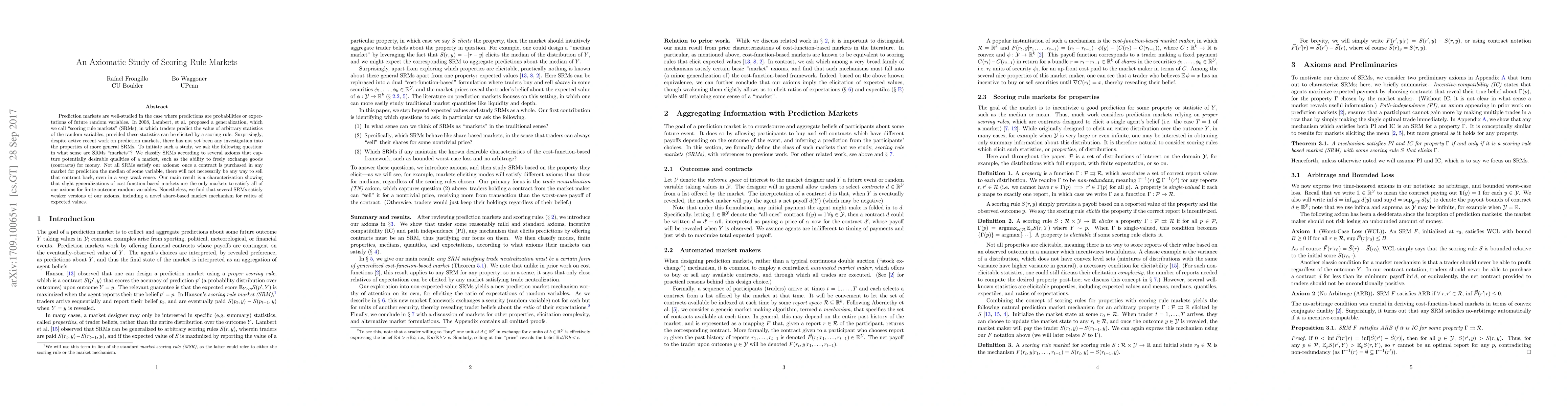

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Axiomatic Characterization of CFMMs and Equivalence to Prediction Markets

Bo Waggoner, Rafael Frongillo, Maneesha Papireddygari

| Title | Authors | Year | Actions |

|---|

Comments (0)