Authors

Summary

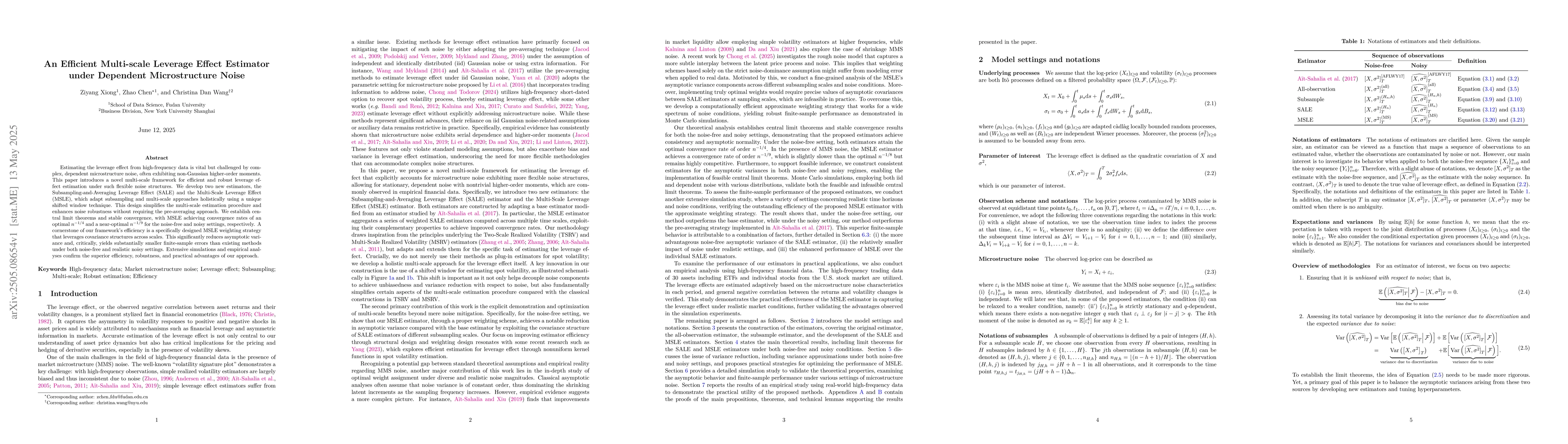

Estimating the leverage effect from high-frequency data is vital but challenged by complex, dependent microstructure noise, often exhibiting non-Gaussian higher-order moments. This paper introduces a novel multi-scale framework for efficient and robust leverage effect estimation under such flexible noise structures. We develop two new estimators, the Subsampling-and-Averaging Leverage Effect (SALE) and the Multi-Scale Leverage Effect (MSLE), which adapt subsampling and multi-scale approaches holistically using a unique shifted window technique. This design simplifies the multi-scale estimation procedure and enhances noise robustness without requiring the pre-averaging approach. We establish central limit theorems and stable convergence, with MSLE achieving convergence rates of an optimal $n^{-1/4}$ and a near-optimal $n^{-1/9}$ for the noise-free and noisy settings, respectively. A cornerstone of our framework's efficiency is a specifically designed MSLE weighting strategy that leverages covariance structures across scales. This significantly reduces asymptotic variance and, critically, yields substantially smaller finite-sample errors than existing methods under both noise-free and realistic noisy settings. Extensive simulations and empirical analyses confirm the superior efficiency, robustness, and practical advantages of our approach.

AI Key Findings

Generated Jun 08, 2025

Methodology

The paper develops two novel estimators, Subsampling-and-Averaging Leverage Effect (SALE) and Multi-Scale Leverage Effect (MSLE), utilizing a unique shifted window technique for robust leverage effect estimation under complex, dependent microstructure noise.

Key Results

- Introduction of SALE and MSLE estimators for efficient leverage effect estimation.

- Establishment of central limit theorems and stable convergence for MSLE with optimal $n^{-1/4}$ and near-optimal $n^{-1/9}$ rates.

Significance

This research is important as it addresses the challenge of estimating the leverage effect from high-frequency data affected by complex, dependent microstructure noise, providing more accurate and robust estimation methods with practical advantages over existing techniques.

Technical Contribution

The paper's main technical contribution is the development of a multi-scale framework with SALE and MSLE estimators, which simplifies estimation procedures and significantly reduces asymptotic variance, yielding smaller finite-sample errors than existing methods.

Novelty

This work is novel due to its holistic integration of subsampling and multi-scale approaches, the unique shifted window technique, and the MSLE weighting strategy that leverages covariance structures across scales for enhanced noise robustness.

Limitations

- The paper does not explicitly discuss specific limitations within the provided content.

- Potential limitations could include reliance on particular assumptions or specific noise structures not covered in the text.

Future Work

- Exploring applications of the proposed methods in various financial markets and datasets.

- Investigating extensions to other time-series analysis problems with similar noise characteristics.

Paper Details

PDF Preview

Similar Papers

Found 4 papersEstimating spot volatility under infinite variation jumps with dependent market microstructure noise

Zhi Liu, Qiang Liu

Asymptotic Normality for the Fourier spot volatility estimator in the presence of microstructure noise

Giacomo Toscano, Maria Elvira Mancino, Tommaso Mariotti

No citations found for this paper.

Comments (0)