Christina Dan Wang

19 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

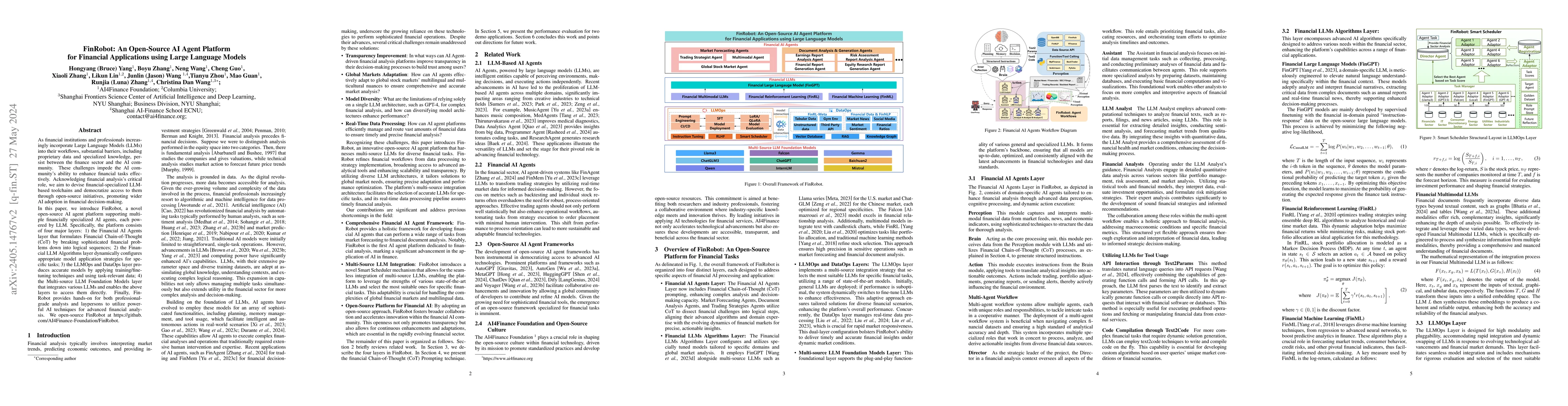

FinRobot: An Open-Source AI Agent Platform for Financial Applications using Large Language Models

As financial institutions and professionals increasingly incorporate Large Language Models (LLMs) into their workflows, substantial barriers, including proprietary data and specialized knowledge, pe...

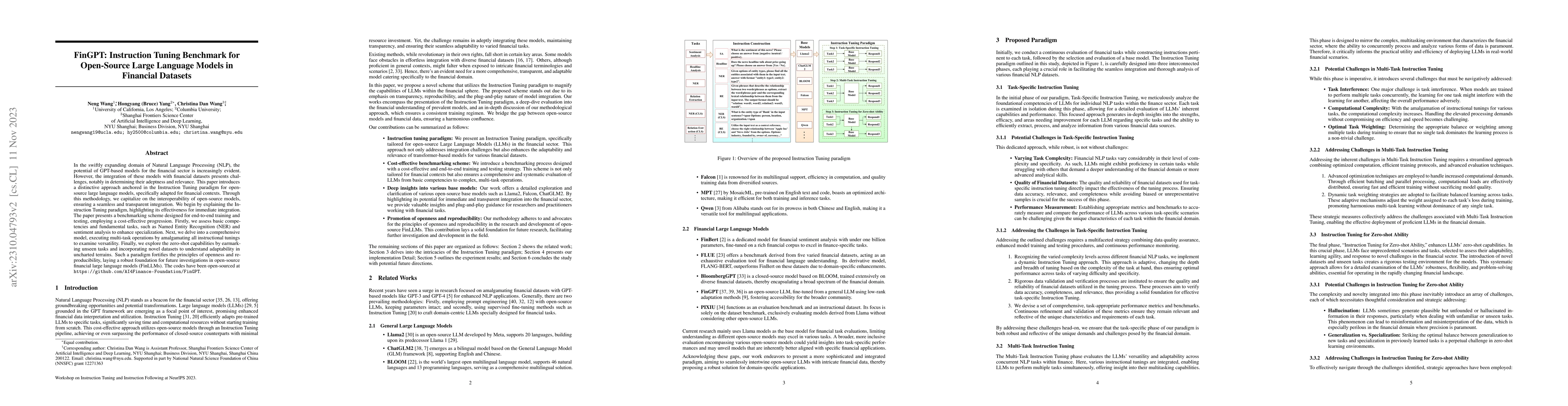

FinGPT: Instruction Tuning Benchmark for Open-Source Large Language Models in Financial Datasets

In the swiftly expanding domain of Natural Language Processing (NLP), the potential of GPT-based models for the financial sector is increasingly evident. However, the integration of these models wit...

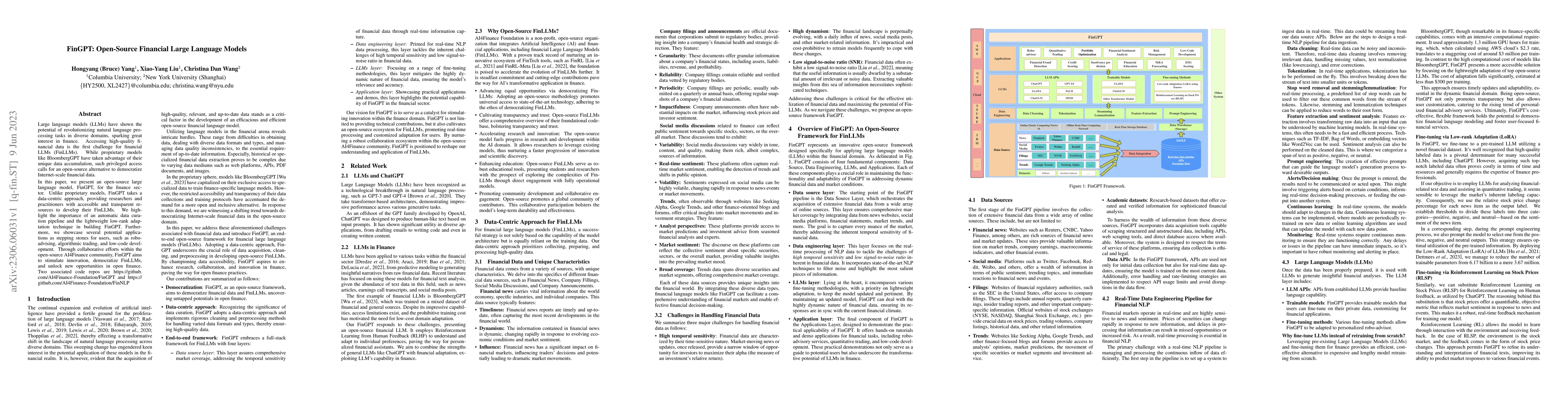

FinGPT: Open-Source Financial Large Language Models

Large language models (LLMs) have shown the potential of revolutionizing natural language processing tasks in diverse domains, sparking great interest in finance. Accessing high-quality financial da...

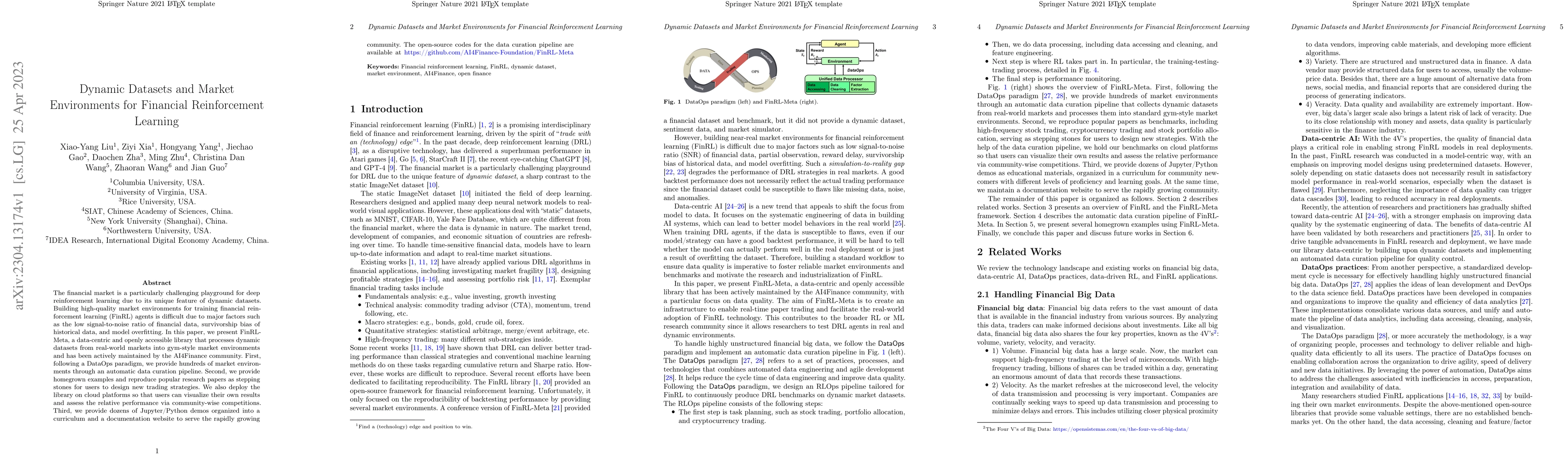

Dynamic Datasets and Market Environments for Financial Reinforcement Learning

The financial market is a particularly challenging playground for deep reinforcement learning due to its unique feature of dynamic datasets. Building high-quality market environments for training fi...

Nearest-Neighbor Sampling Based Conditional Independence Testing

The conditional randomization test (CRT) was recently proposed to test whether two random variables X and Y are conditionally independent given random variables Z. The CRT assumes that the condition...

FinRL-Meta: Market Environments and Benchmarks for Data-Driven Financial Reinforcement Learning

Finance is a particularly difficult playground for deep reinforcement learning. However, establishing high-quality market environments and benchmarks for financial reinforcement learning is challeng...

Deep Reinforcement Learning for Cryptocurrency Trading: Practical Approach to Address Backtest Overfitting

Designing profitable and reliable trading strategies is challenging in the highly volatile cryptocurrency market. Existing works applied deep reinforcement learning methods and optimistically report...

FinRL-Meta: A Universe of Near-Real Market Environments for Data-Driven Deep Reinforcement Learning in Quantitative Finance

Deep reinforcement learning (DRL) has shown huge potentials in building financial market simulators recently. However, due to the highly complex and dynamic nature of real-world markets, raw histori...

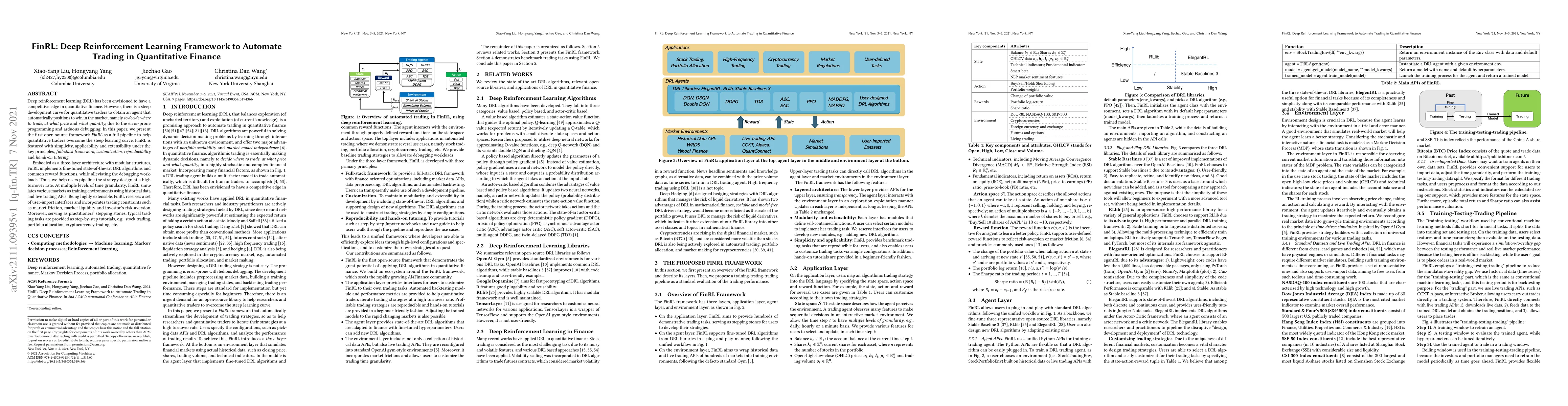

FinRL: Deep Reinforcement Learning Framework to Automate Trading in Quantitative Finance

Deep reinforcement learning (DRL) has been envisioned to have a competitive edge in quantitative finance. However, there is a steep development curve for quantitative traders to obtain an agent that...

FinRL: A Deep Reinforcement Learning Library for Automated Stock Trading in Quantitative Finance

As deep reinforcement learning (DRL) has been recognized as an effective approach in quantitative finance, getting hands-on experiences is attractive to beginners. However, to train a practical DRL ...

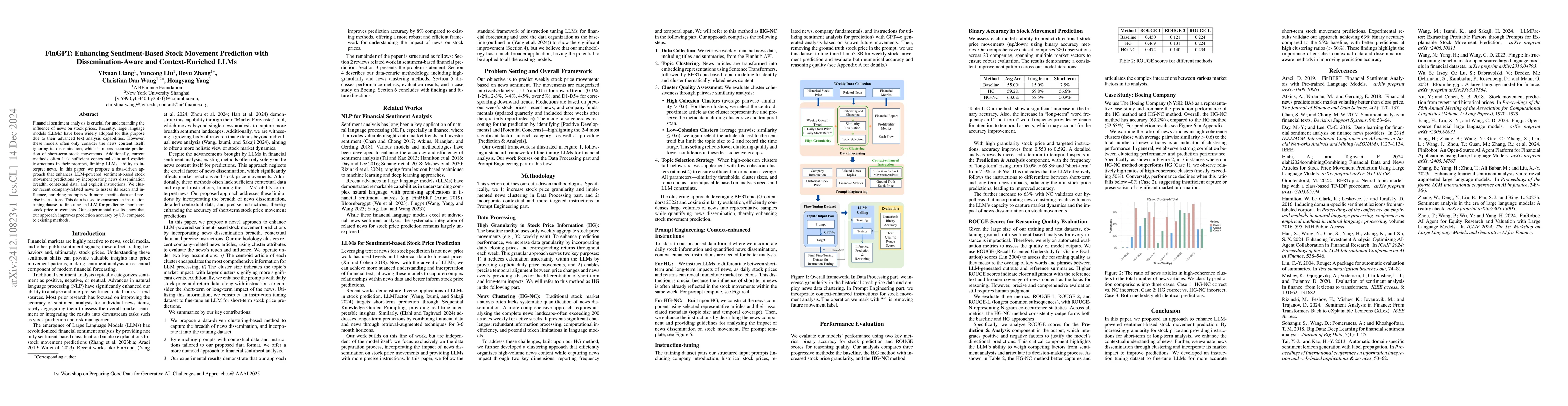

FinGPT: Enhancing Sentiment-Based Stock Movement Prediction with Dissemination-Aware and Context-Enriched LLMs

Financial sentiment analysis is crucial for understanding the influence of news on stock prices. Recently, large language models (LLMs) have been widely adopted for this purpose due to their advanced ...

Open FinLLM Leaderboard: Towards Financial AI Readiness

Financial large language models (FinLLMs) with multimodal capabilities are envisioned to revolutionize applications across business, finance, accounting, and auditing. However, real-world adoption req...

Fréchet Cumulative Covariance Net for Deep Nonlinear Sufficient Dimension Reduction with Random Objects

Nonlinear sufficient dimension reduction\citep{libing_generalSDR}, which constructs nonlinear low-dimensional representations to summarize essential features of high-dimensional data, is an important ...

NewsNet-SDF: Stochastic Discount Factor Estimation with Pretrained Language Model News Embeddings via Adversarial Networks

Stochastic Discount Factor (SDF) models provide a unified framework for asset pricing and risk assessment, yet traditional formulations struggle to incorporate unstructured textual information. We int...

An Efficient Multi-scale Leverage Effect Estimator under Dependent Microstructure Noise

Estimating the leverage effect from high-frequency data is vital but challenged by complex, dependent microstructure noise, often exhibiting non-Gaussian higher-order moments. This paper introduces a ...

Robust Estimation of Double Autoregressive Models via Normal Mixture QMLE

This paper investigates the estimation of the double autoregressive (DAR) model in the presence of skewed and heavy-tailed innovations. We propose a novel Normal Mixture Quasi-Maximum Likelihood Estim...

Not All Tokens Are What You Need In Thinking

Modern reasoning models, such as OpenAI's o1 and DeepSeek-R1, exhibit impressive problem-solving capabilities but suffer from critical inefficiencies: high inference latency, excessive computational r...

FinRobot: Generative Business Process AI Agents for Enterprise Resource Planning in Finance

Enterprise Resource Planning (ERP) systems serve as the digital backbone of modern financial institutions, yet they continue to rely on static, rule-based workflows that limit adaptability, scalabilit...

Yule-Walker Estimation for Functional Time Series in Hilbert Space

Recent advances in data collection technologies have led to the widespread availability of functional data observed over time, often exhibiting strong temporal dependence. However, existing methodolog...