Summary

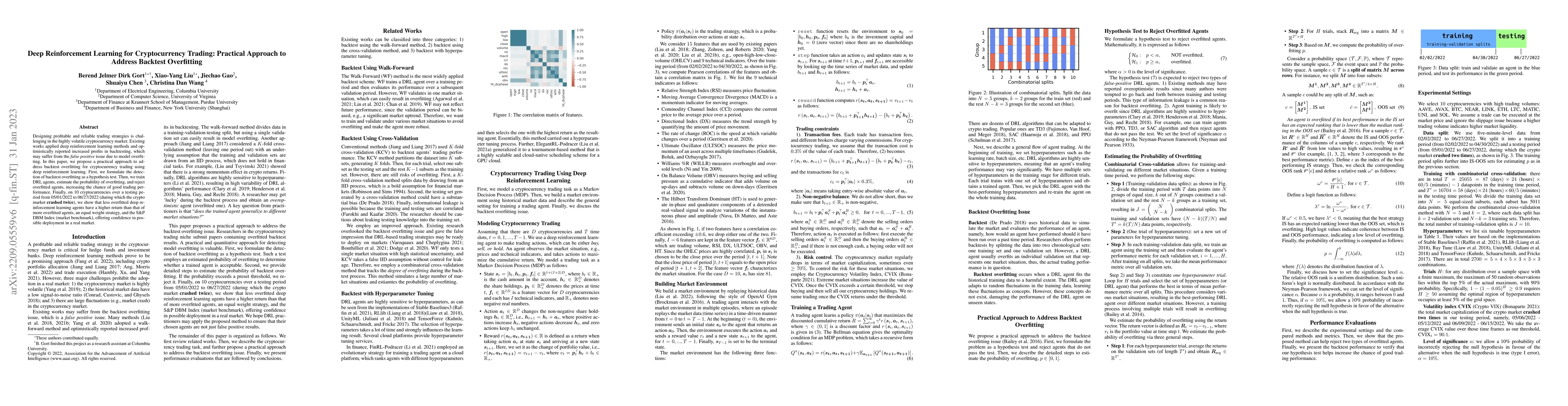

Designing profitable and reliable trading strategies is challenging in the highly volatile cryptocurrency market. Existing works applied deep reinforcement learning methods and optimistically reported increased profits in backtesting, which may suffer from the false positive issue due to overfitting. In this paper, we propose a practical approach to address backtest overfitting for cryptocurrency trading using deep reinforcement learning. First, we formulate the detection of backtest overfitting as a hypothesis test. Then, we train the DRL agents, estimate the probability of overfitting, and reject the overfitted agents, increasing the chance of good trading performance. Finally, on 10 cryptocurrencies over a testing period from 05/01/2022 to 06/27/2022 (during which the crypto market crashed two times), we show that the less overfitted deep reinforcement learning agents have a higher return than that of more overfitted agents, an equal weight strategy, and the S&P DBM Index (market benchmark), offering confidence in possible deployment to a real market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPractical Deep Reinforcement Learning Approach for Stock Trading

Xiao-Yang Liu, Shan Zhong, Hongyang Yang et al.

An Ensemble Method of Deep Reinforcement Learning for Automated Cryptocurrency Trading

Diego Klabjan, Shuyang Wang

A Framework for Empowering Reinforcement Learning Agents with Causal Analysis: Enhancing Automated Cryptocurrency Trading

Dhananjay Thiruvady, Asef Nazari, Rasoul Amirzadeh et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)