Authors

Summary

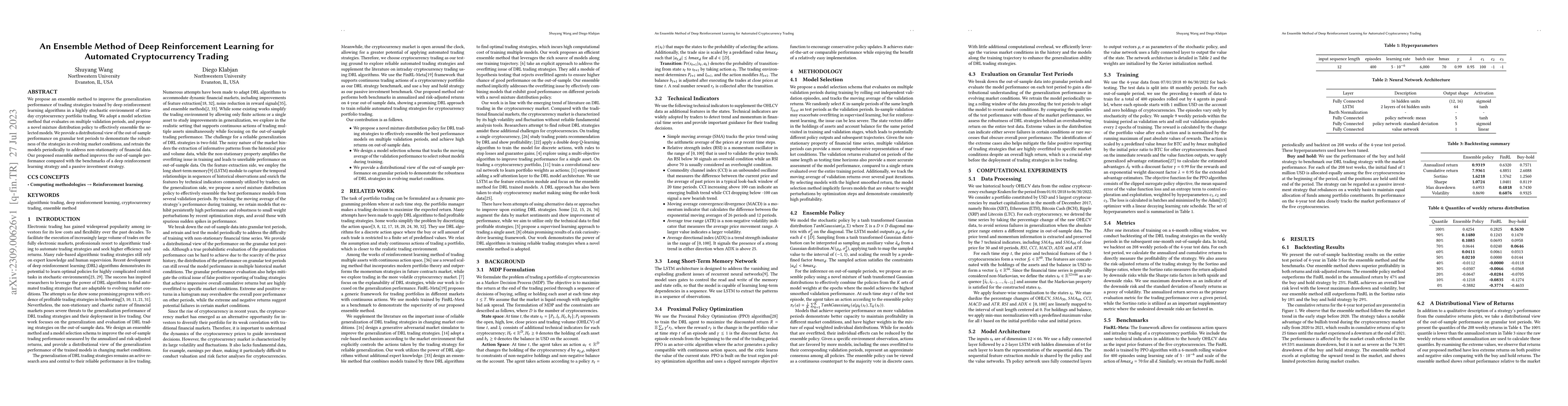

We propose an ensemble method to improve the generalization performance of trading strategies trained by deep reinforcement learning algorithms in a highly stochastic environment of intraday cryptocurrency portfolio trading. We adopt a model selection method that evaluates on multiple validation periods, and propose a novel mixture distribution policy to effectively ensemble the selected models. We provide a distributional view of the out-of-sample performance on granular test periods to demonstrate the robustness of the strategies in evolving market conditions, and retrain the models periodically to address non-stationarity of financial data. Our proposed ensemble method improves the out-of-sample performance compared with the benchmarks of a deep reinforcement learning strategy and a passive investment strategy.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Framework for Empowering Reinforcement Learning Agents with Causal Analysis: Enhancing Automated Cryptocurrency Trading

Dhananjay Thiruvady, Asef Nazari, Rasoul Amirzadeh et al.

Deep Reinforcement Learning for Cryptocurrency Trading: Practical Approach to Address Backtest Overfitting

Xiao-Yang Liu, Jiechao Gao, Christina Dan Wang et al.

An Application of Deep Reinforcement Learning to Algorithmic Trading

Damien Ernst, Thibaut Théate

No citations found for this paper.

Comments (0)