Summary

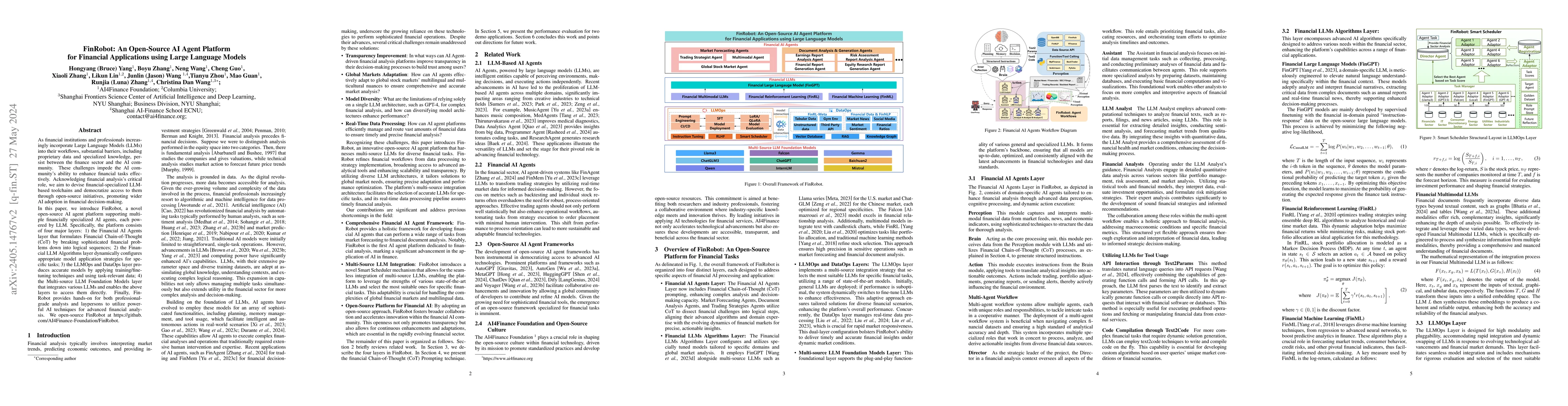

As financial institutions and professionals increasingly incorporate Large Language Models (LLMs) into their workflows, substantial barriers, including proprietary data and specialized knowledge, persist between the finance sector and the AI community. These challenges impede the AI community's ability to enhance financial tasks effectively. Acknowledging financial analysis's critical role, we aim to devise financial-specialized LLM-based toolchains and democratize access to them through open-source initiatives, promoting wider AI adoption in financial decision-making. In this paper, we introduce FinRobot, a novel open-source AI agent platform supporting multiple financially specialized AI agents, each powered by LLM. Specifically, the platform consists of four major layers: 1) the Financial AI Agents layer that formulates Financial Chain-of-Thought (CoT) by breaking sophisticated financial problems down into logical sequences; 2) the Financial LLM Algorithms layer dynamically configures appropriate model application strategies for specific tasks; 3) the LLMOps and DataOps layer produces accurate models by applying training/fine-tuning techniques and using task-relevant data; 4) the Multi-source LLM Foundation Models layer that integrates various LLMs and enables the above layers to access them directly. Finally, FinRobot provides hands-on for both professional-grade analysts and laypersons to utilize powerful AI techniques for advanced financial analysis. We open-source FinRobot at \url{https://github.com/AI4Finance-Foundation/FinRobot}.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinRobot: AI Agent for Equity Research and Valuation with Large Language Models

Yilin Wu, Hongyang Yang, Tianyu Zhou et al.

FinGPT: Open-Source Financial Large Language Models

Xiao-Yang Liu, Hongyang Yang, Christina Dan Wang

Open-FinLLMs: Open Multimodal Large Language Models for Financial Applications

Benyou Wang, Duanyu Feng, Yongfu Dai et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)