Summary

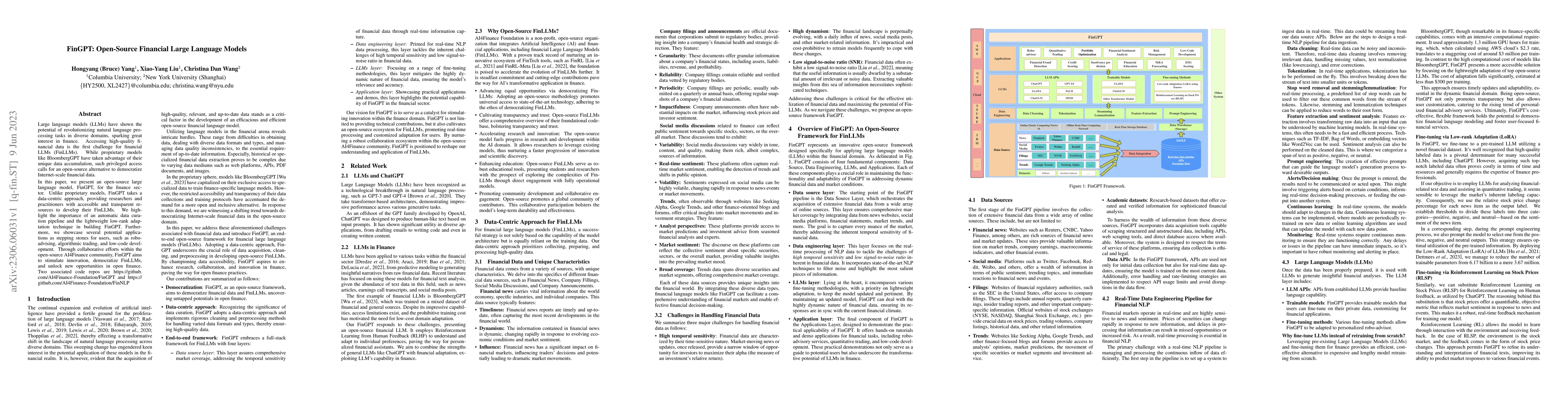

Large language models (LLMs) have shown the potential of revolutionizing natural language processing tasks in diverse domains, sparking great interest in finance. Accessing high-quality financial data is the first challenge for financial LLMs (FinLLMs). While proprietary models like BloombergGPT have taken advantage of their unique data accumulation, such privileged access calls for an open-source alternative to democratize Internet-scale financial data. In this paper, we present an open-source large language model, FinGPT, for the finance sector. Unlike proprietary models, FinGPT takes a data-centric approach, providing researchers and practitioners with accessible and transparent resources to develop their FinLLMs. We highlight the importance of an automatic data curation pipeline and the lightweight low-rank adaptation technique in building FinGPT. Furthermore, we showcase several potential applications as stepping stones for users, such as robo-advising, algorithmic trading, and low-code development. Through collaborative efforts within the open-source AI4Finance community, FinGPT aims to stimulate innovation, democratize FinLLMs, and unlock new opportunities in open finance. Two associated code repos are \url{https://github.com/AI4Finance-Foundation/FinGPT} and \url{https://github.com/AI4Finance-Foundation/FinNLP}

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinGPT: Instruction Tuning Benchmark for Open-Source Large Language Models in Financial Datasets

Neng Wang, Hongyang Yang, Christina Dan Wang

FinGPT: Democratizing Internet-scale Data for Financial Large Language Models

Daochen Zha, Xiao-Yang Liu, Hongyang Yang et al.

FinGPT: Large Generative Models for a Small Language

Niklas Muennighoff, Thomas Wolf, Anni Eskelinen et al.

FinRobot: An Open-Source AI Agent Platform for Financial Applications using Large Language Models

Xiaoli Zhang, Junlin Wang, Neng Wang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)