Summary

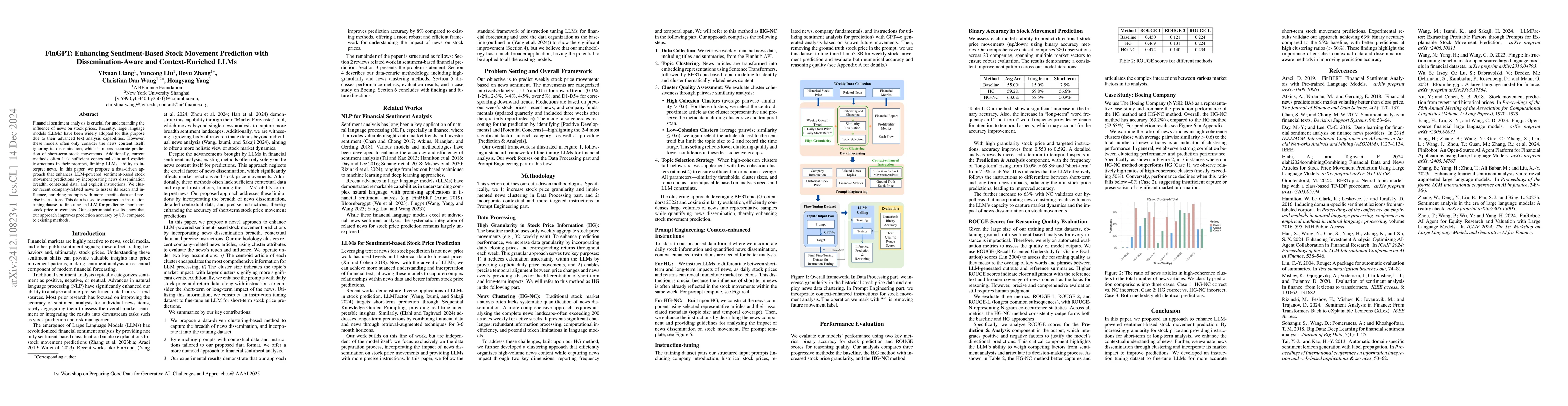

Financial sentiment analysis is crucial for understanding the influence of news on stock prices. Recently, large language models (LLMs) have been widely adopted for this purpose due to their advanced text analysis capabilities. However, these models often only consider the news content itself, ignoring its dissemination, which hampers accurate prediction of short-term stock movements. Additionally, current methods often lack sufficient contextual data and explicit instructions in their prompts, limiting LLMs' ability to interpret news. In this paper, we propose a data-driven approach that enhances LLM-powered sentiment-based stock movement predictions by incorporating news dissemination breadth, contextual data, and explicit instructions. We cluster recent company-related news to assess its reach and influence, enriching prompts with more specific data and precise instructions. This data is used to construct an instruction tuning dataset to fine-tune an LLM for predicting short-term stock price movements. Our experimental results show that our approach improves prediction accuracy by 8\% compared to existing methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersSARF: Enhancing Stock Market Prediction with Sentiment-Augmented Random Forest

Saber Talazadeh, Dragan Perakovic

Taureau: A Stock Market Movement Inference Framework Based on Twitter Sentiment Analysis

Joshua Johnson, Nicholas Milikich

GRUvader: Sentiment-Informed Stock Market Prediction

Bayode Ogunleye, Olamilekan Shobayo, Akhila Mamillapalli et al.

No citations found for this paper.

Comments (0)