Summary

This paper contributes a new machine learning solution for stock movement prediction, which aims to predict whether the price of a stock will be up or down in the near future. The key novelty is that we propose to employ adversarial training to improve the generalization of a neural network prediction model. The rationality of adversarial training here is that the input features to stock prediction are typically based on stock price, which is essentially a stochastic variable and continuously changed with time by nature. As such, normal training with static price-based features (e.g. the close price) can easily overfit the data, being insufficient to obtain reliable models. To address this problem, we propose to add perturbations to simulate the stochasticity of price variable, and train the model to work well under small yet intentional perturbations. Extensive experiments on two real-world stock data show that our method outperforms the state-of-the-art solution with 3.11% relative improvements on average w.r.t. accuracy, validating the usefulness of adversarial training for stock prediction task.

AI Key Findings

Generated Sep 03, 2025

Methodology

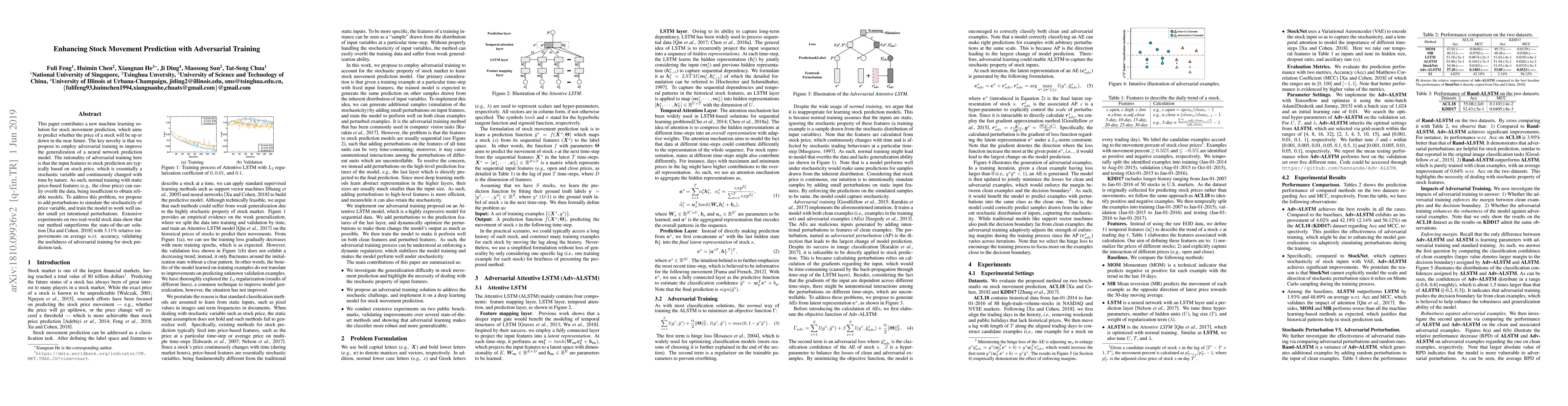

The paper proposes an Adversarial Attentive LSTM (Adv-ALSTM) for stock movement prediction, utilizing adversarial training to simulate stochasticity in stock price features, enhancing model generalization.

Key Results

- Adv-ALSTM outperforms state-of-the-art methods with 3.11% relative improvement on average accuracy.

- Adv-ALSTM shows significant improvements over StockNet, another method capturing stochasticity using VAE.

- ALSTM, a baseline, outperforms LSTM, validating the impact of attention mechanisms.

- Adv-ALSTM demonstrates enhanced robustness against adversarial examples compared to ALSTM.

- Adversarial training pushes the decision boundary farther from clean examples, enhancing model robustness and generalization.

Significance

This research is significant as it addresses the weak generalization ability of neural network solutions for stock movement prediction by accounting for the stochasticity of stock prices, which previous works often overlook.

Technical Contribution

The paper introduces an adversarial training approach tailored for time-series data, specifically stock movement prediction, to simulate stochasticity and improve model robustness.

Novelty

This work is novel as it extends adversarial learning to time-series analytics, specifically for stock movement prediction, addressing a gap in existing research that primarily focuses on image classification tasks.

Limitations

- The method relies on historical stock data, which may not perfectly predict future market behavior.

- Computational cost of generating adversarial examples could be high for extensive datasets.

Future Work

- Explore Adv-ALSTM for predicting movement in other assets like commodities.

- Apply adversarial training to stock movement prediction models with different structures, such as CNNs.

- Investigate the effect of adversarial training on fundamental analysis methods for stock movement prediction.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHigher Order Transformers: Enhancing Stock Movement Prediction On Multimodal Time-Series Data

Reihaneh Rabbany, Guillaume Rabusseau, Soroush Omranpour

FinGPT: Enhancing Sentiment-Based Stock Movement Prediction with Dissemination-Aware and Context-Enriched LLMs

Hongyang Yang, Boyu Zhang, Christina Dan Wang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)