Summary

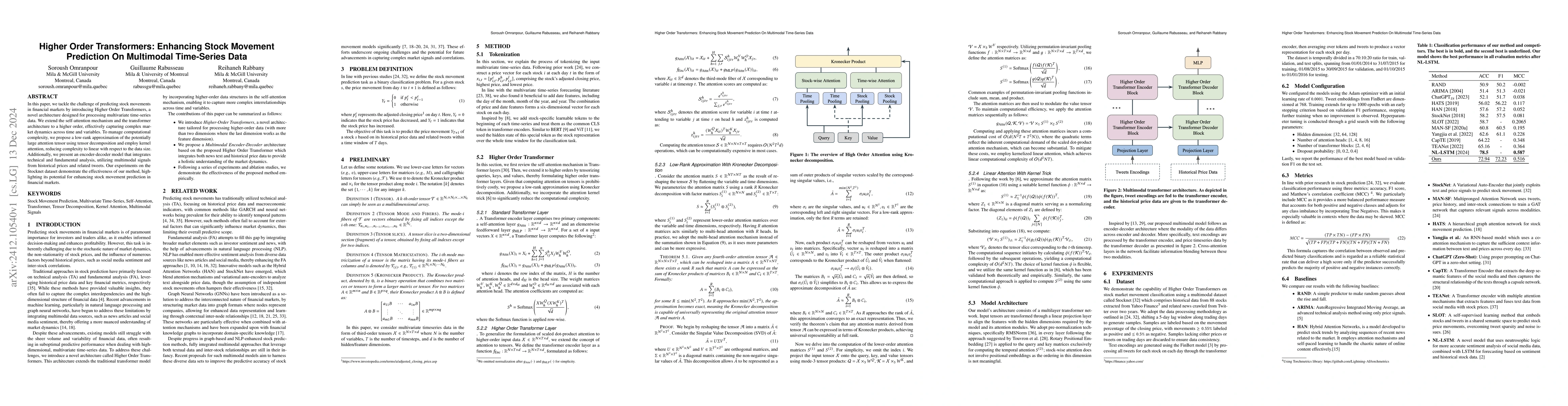

In this paper, we tackle the challenge of predicting stock movements in financial markets by introducing Higher Order Transformers, a novel architecture designed for processing multivariate time-series data. We extend the self-attention mechanism and the transformer architecture to a higher order, effectively capturing complex market dynamics across time and variables. To manage computational complexity, we propose a low-rank approximation of the potentially large attention tensor using tensor decomposition and employ kernel attention, reducing complexity to linear with respect to the data size. Additionally, we present an encoder-decoder model that integrates technical and fundamental analysis, utilizing multimodal signals from historical prices and related tweets. Our experiments on the Stocknet dataset demonstrate the effectiveness of our method, highlighting its potential for enhancing stock movement prediction in financial markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Similar Papers

Found 4 papersIncorporating Pre-trained Model Prompting in Multimodal Stock Volume Movement Prediction

Yi Liu, Xu Sun, Zhiyuan Zhang et al.

Stock Movement Prediction with Multimodal Stable Fusion via Gated Cross-Attention Mechanism

Yueting Zhuang, Weiming Lu, Chang Zong et al.

Transformers with Attentive Federated Aggregation for Time Series Stock Forecasting

Ye Lin Tun, Chu Myaet Thwal, Choong Seon Hong et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)