Summary

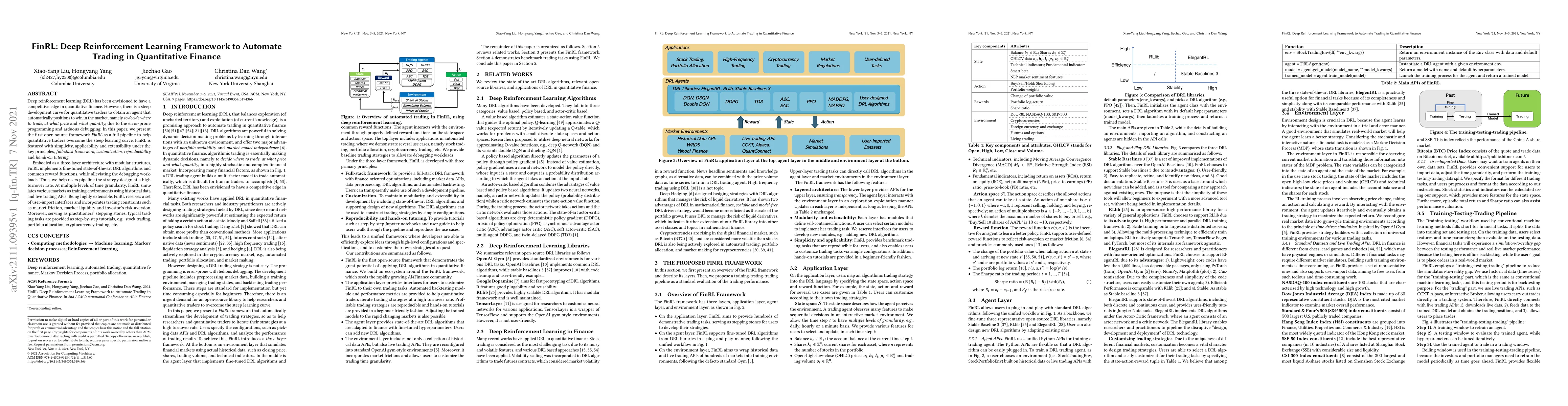

Deep reinforcement learning (DRL) has been envisioned to have a competitive edge in quantitative finance. However, there is a steep development curve for quantitative traders to obtain an agent that automatically positions to win in the market, namely \textit{to decide where to trade, at what price} and \textit{what quantity}, due to the error-prone programming and arduous debugging. In this paper, we present the first open-source framework \textit{FinRL} as a full pipeline to help quantitative traders overcome the steep learning curve. FinRL is featured with simplicity, applicability and extensibility under the key principles, \textit{full-stack framework, customization, reproducibility} and \textit{hands-on tutoring}. Embodied as a three-layer architecture with modular structures, FinRL implements fine-tuned state-of-the-art DRL algorithms and common reward functions, while alleviating the debugging workloads. Thus, we help users pipeline the strategy design at a high turnover rate. At multiple levels of time granularity, FinRL simulates various markets as training environments using historical data and live trading APIs. Being highly extensible, FinRL reserves a set of user-import interfaces and incorporates trading constraints such as market friction, market liquidity and investor's risk-aversion. Moreover, serving as practitioners' stepping stones, typical trading tasks are provided as step-by-step tutorials, e.g., stock trading, portfolio allocation, cryptocurrency trading, etc.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinRL: A Deep Reinforcement Learning Library for Automated Stock Trading in Quantitative Finance

Qian Chen, Liuqing Yang, Xiao-Yang Liu et al.

FinRL-Meta: A Universe of Near-Real Market Environments for Data-Driven Deep Reinforcement Learning in Quantitative Finance

Jian Guo, Liuqing Yang, Zhaoran Wang et al.

Safe-FinRL: A Low Bias and Variance Deep Reinforcement Learning Implementation for High-Freq Stock Trading

Chenliang Li, Zitao Song, Xuyang Jin

| Title | Authors | Year | Actions |

|---|

Comments (0)