Summary

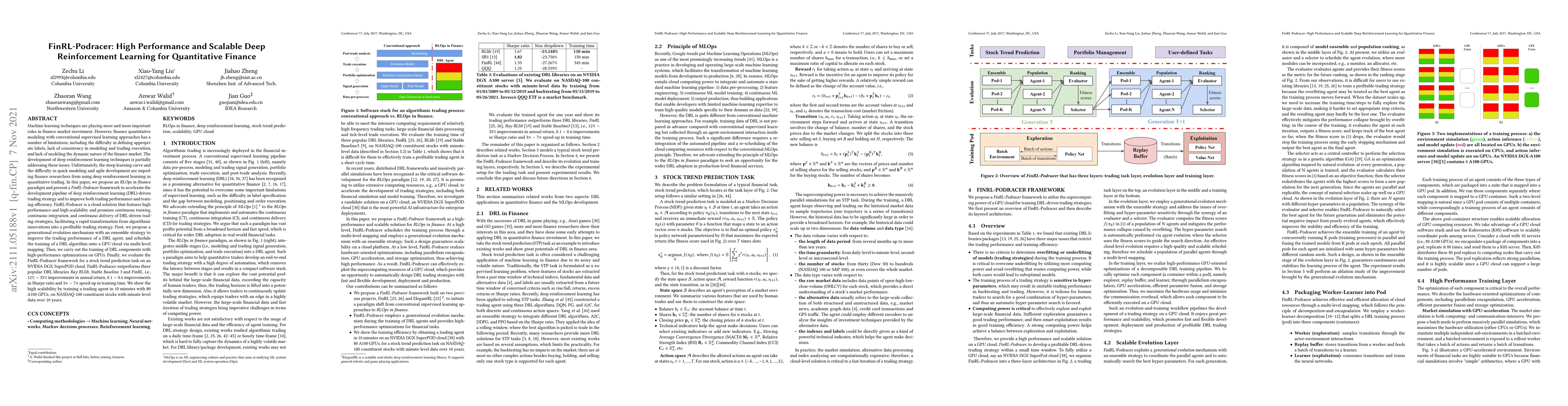

Machine learning techniques are playing more and more important roles in finance market investment. However, finance quantitative modeling with conventional supervised learning approaches has a number of limitations. The development of deep reinforcement learning techniques is partially addressing these issues. Unfortunately, the steep learning curve and the difficulty in quick modeling and agile development are impeding finance researchers from using deep reinforcement learning in quantitative trading. In this paper, we propose an RLOps in finance paradigm and present a FinRL-Podracer framework to accelerate the development pipeline of deep reinforcement learning (DRL)-driven trading strategy and to improve both trading performance and training efficiency. FinRL-Podracer is a cloud solution that features high performance and high scalability and promises continuous training, continuous integration, and continuous delivery of DRL-driven trading strategies, facilitating a rapid transformation from algorithmic innovations into a profitable trading strategy. First, we propose a generational evolution mechanism with an ensemble strategy to improve the trading performance of a DRL agent, and schedule the training of a DRL algorithm onto a GPU cloud via multi-level mapping. Then, we carry out the training of DRL components with high-performance optimizations on GPUs. Finally, we evaluate the FinRL-Podracer framework for a stock trend prediction task on an NVIDIA DGX SuperPOD cloud. FinRL-Podracer outperforms three popular DRL libraries Ray RLlib, Stable Baseline 3 and FinRL, i.e., 12% \sim 35% improvements in annual return, 0.1 \sim 0.6 improvements in Sharpe ratio and 3 times \sim 7 times speed-up in training time. We show the high scalability by training a trading agent in 10 minutes with $80$ A100 GPUs, on NASDAQ-100 constituent stocks with minute-level data over 10 years.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFinRL: A Deep Reinforcement Learning Library for Automated Stock Trading in Quantitative Finance

Qian Chen, Liuqing Yang, Xiao-Yang Liu et al.

ElegantRL-Podracer: Scalable and Elastic Library for Cloud-Native Deep Reinforcement Learning

Jian Guo, Michael I. Jordan, Zhuoran Yang et al.

FinRL-Meta: A Universe of Near-Real Market Environments for Data-Driven Deep Reinforcement Learning in Quantitative Finance

Jian Guo, Liuqing Yang, Zhaoran Wang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)