Authors

Summary

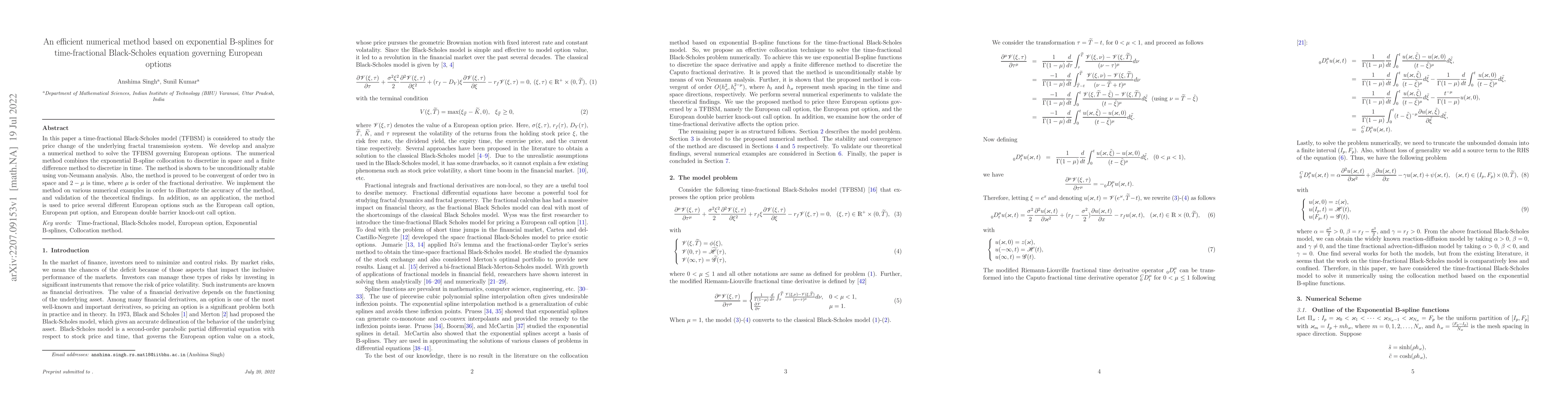

In this paper a time-fractional Black-Scholes model (TFBSM) is considered to study the price change of the underlying fractal transmission system. We develop and analyze a numerical method to solve the TFBSM governing European options. The numerical method combines the exponential B-spline collocation to discretize in space and a finite difference method to discretize in time. The method is shown to be unconditionally stable using von-Neumann analysis. Also, the method is proved to be convergent of order two in space and $2-\mu$ is time, where $\mu$ is order of the fractional derivative. We implement the method on various numerical examples in order to illustrate the accuracy of the method, and validation of the theoretical findings. In addition, as an application, the method is used to price several different European options such as the European call option, European put option, and European double barrier knock-out call option.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersSymmetries of the Black-Scholes-Merton equation for European options

Landysh N. Bakirova, Marina A. Shurygina, Vadim V. Shurygin, Jr

| Title | Authors | Year | Actions |

|---|

Comments (0)