Summary

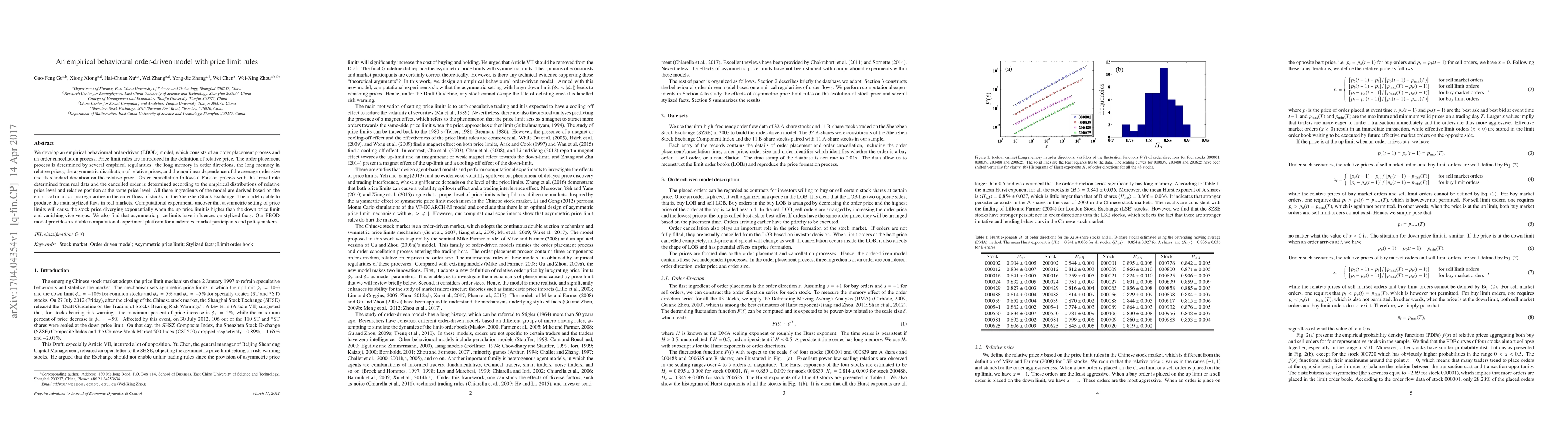

We develop an empirical behavioural order-driven (EBOD) model, which consists of an order placement process and an order cancellation process. Price limit rules are introduced in the definition of relative price. The order placement process is determined by several empirical regularities: the long memory in order directions, the long memory in relative prices, the asymmetric distribution of relative prices, and the nonlinear dependence of the average order size and its standard deviation on the relative price. Order cancellation follows a Poisson process with the arrival rate determined from real data and the cancelled order is determined according to the empirical distributions of relative price level and relative position at the same price level. All these ingredients of the model are derived based on the empirical microscopic regularities in the order flows of stocks on the Shenzhen Stock Exchange. The model is able to produce the main stylized facts in real markets. Computational experiments uncover that asymmetric setting of price limits will cause the stock price diverging exponentially when the up price limit is higher than the down price limit and vanishing vice versus. We also find that asymmetric price limits have influences on stylized facts. Our EBOD model provides a suitable computational experiment platform for academics, market participants and policy makers.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)