Summary

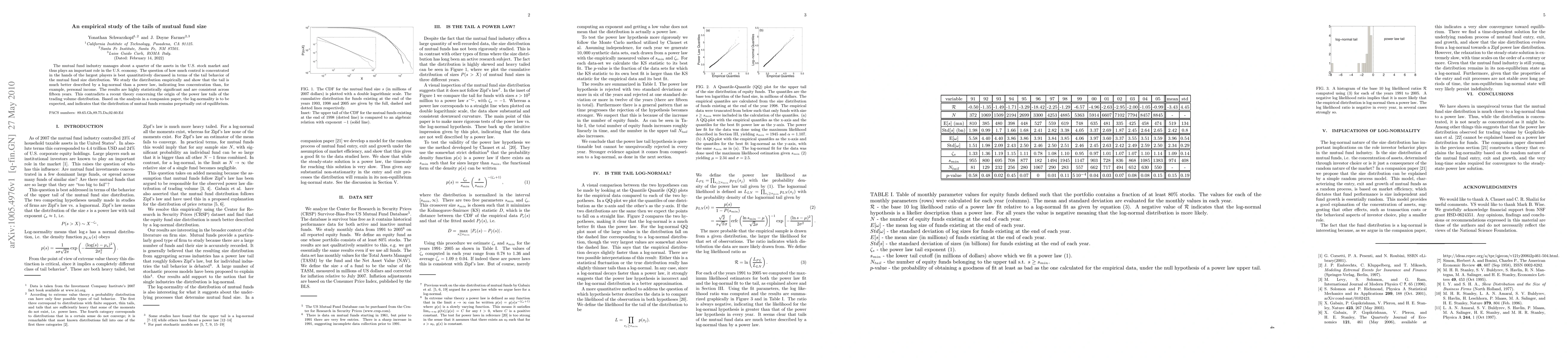

The mutual fund industry manages about a quarter of the assets in the U.S. stock market and thus plays an important role in the U.S. economy. The question of how much control is concentrated in the hands of the largest players is best quantitatively discussed in terms of the tail behavior of the mutual fund size distribution. We study the distribution empirically and show that the tail is much better described by a log-normal than a power law, indicating less concentration than, for example, personal income. The results are highly statistically significant and are consistent across fifteen years. This contradicts a recent theory concerning the origin of the power law tails of the trading volume distribution. Based on the analysis in a companion paper, the log-normality is to be expected, and indicates that the distribution of mutual funds remains perpetually out of equilibrium.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)