Summary

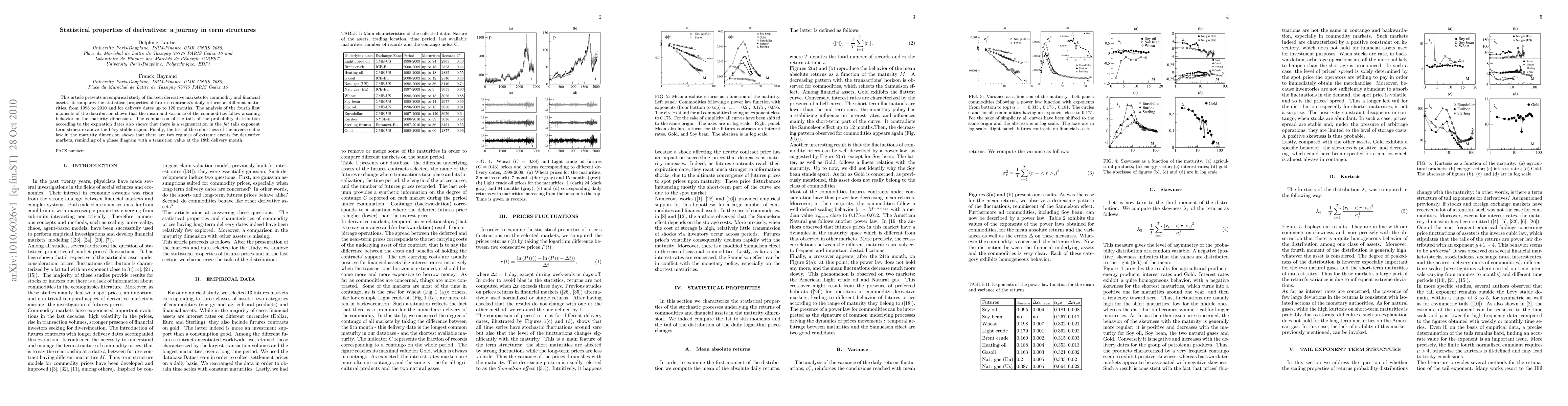

This article presents an empirical study of thirteen derivative markets for commodity and financial assets. It compares the statistical properties of futures contracts's daily returns at different maturities, from 1998 to 2010 and for delivery dates up to 120 months. The analysis of the fourth first moments of the distribution shows that the mean and variance of the commodities follow a scaling behavior in the maturity dimension. The comparison of the tails of the probability distribution according to the expiration dates also shows that there is a segmentation in the fat tails exponent term structure above the L'evy stable region. Finally, the test of the robustness of the inverse cubic law in the maturity dimension shows that there are two regimes of extreme events for derivative markets, reminding of a phase diagram with a transition value at the 18th delivery month.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Comments (0)