Summary

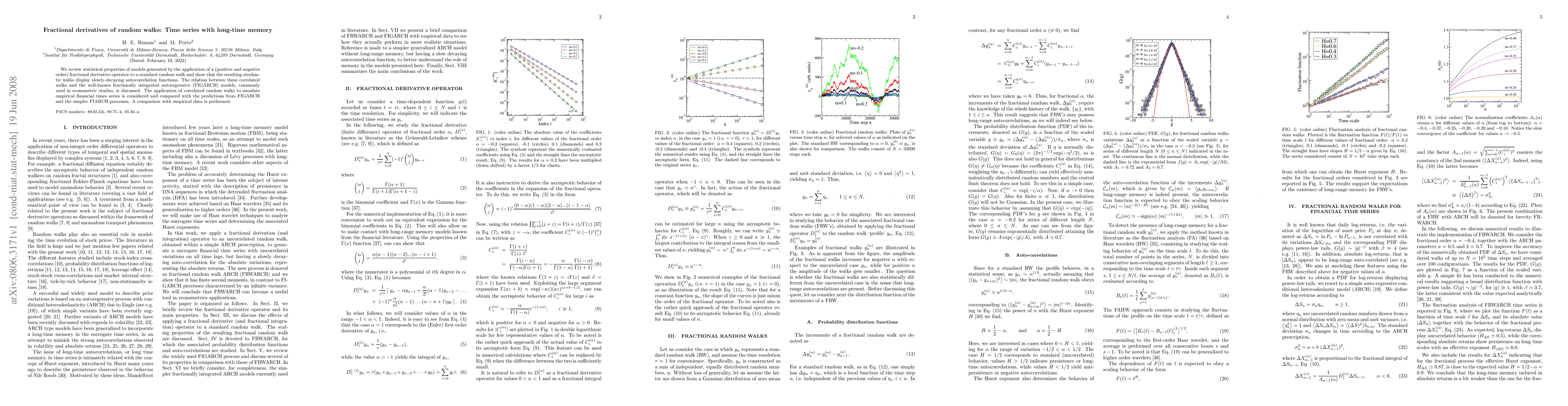

We review statistical properties of models generated by the application of a (positive and negative order) fractional derivative operator to a standard random walk and show that the resulting stochastic walks display slowly-decaying autocorrelation functions. The relation between these correlated walks and the well-known fractionally integrated autoregressive (FIGARCH) models, commonly used in econometric studies, is discussed. The application of correlated random walks to simulate empirical financial times series is considered and compared with the predictions from FIGARCH and the simpler FIARCH processes. A comparison with empirical data is performed.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFractional SDE-Net: Generation of Time Series Data with Long-term Memory

Kohei Hayashi, Kei Nakagawa

| Title | Authors | Year | Actions |

|---|

Comments (0)