Summary

In this paper we present an evolutionary optimization approach to solve the risk parity portfolio selection problem. While there exist convex optimization approaches to solve this problem when long-only portfolios are considered, the optimization problem becomes non-trivial in the long-short case. To solve this problem, we propose a genetic algorithm as well as a local search heuristic. This algorithmic framework is able to compute solutions successfully. Numerical results using real-world data substantiate the practicability of the approach presented in this paper.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

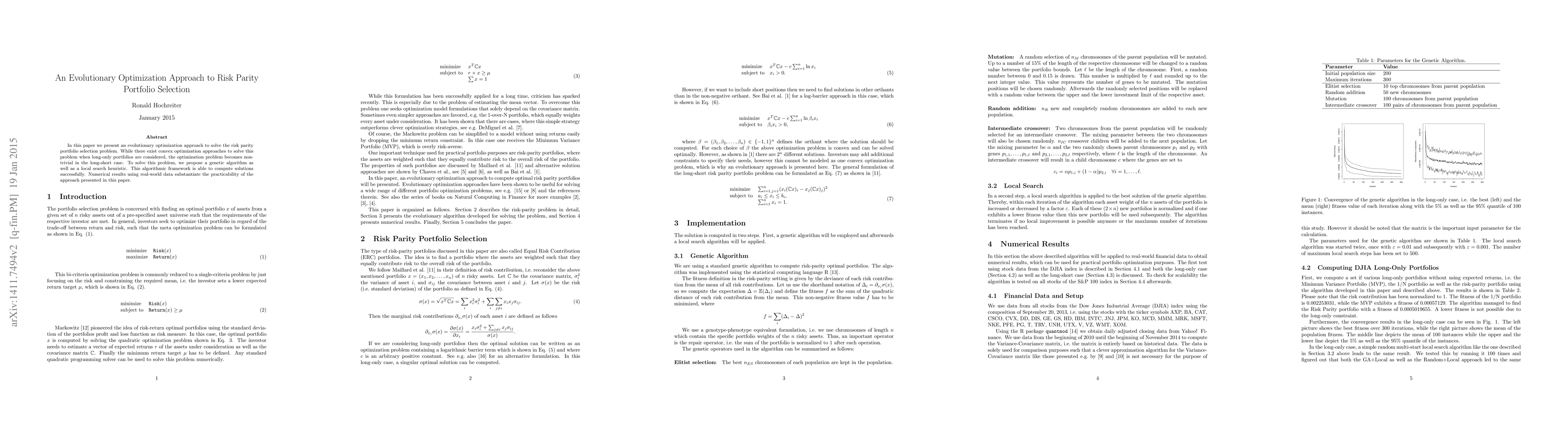

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA return-diversification approach to portfolio selection

Francesco Cesarone, Manuel Luis Martino, Rosella Giacometti et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)