Summary

Long-term relative arbitrage exists in markets where the excess growth rate of the market portfolio is bounded away from zero. Here it is shown that under a time-homogeneity hypothesis this condition will also imply the existence of relative arbitrage over arbitrarily short intervals.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

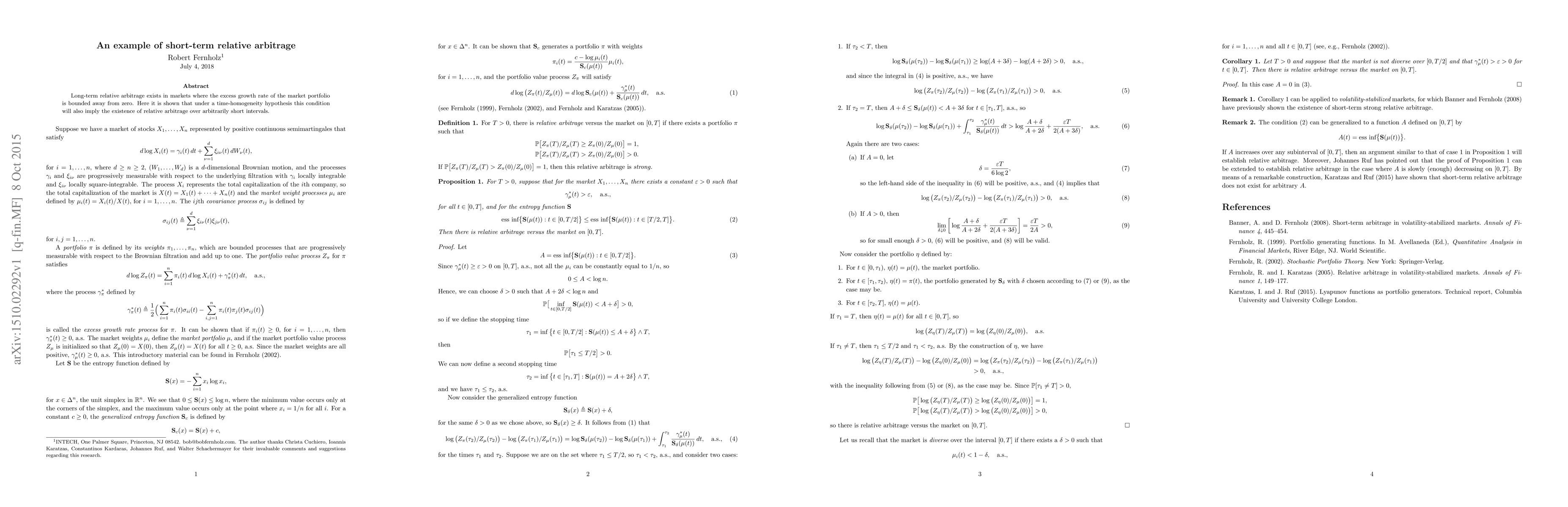

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRelative Arbitrage Opportunities in an Extended Mean Field System

Tomoyuki Ichiba, Nicole Tianjiao Yang

| Title | Authors | Year | Actions |

|---|

Comments (0)