Authors

Summary

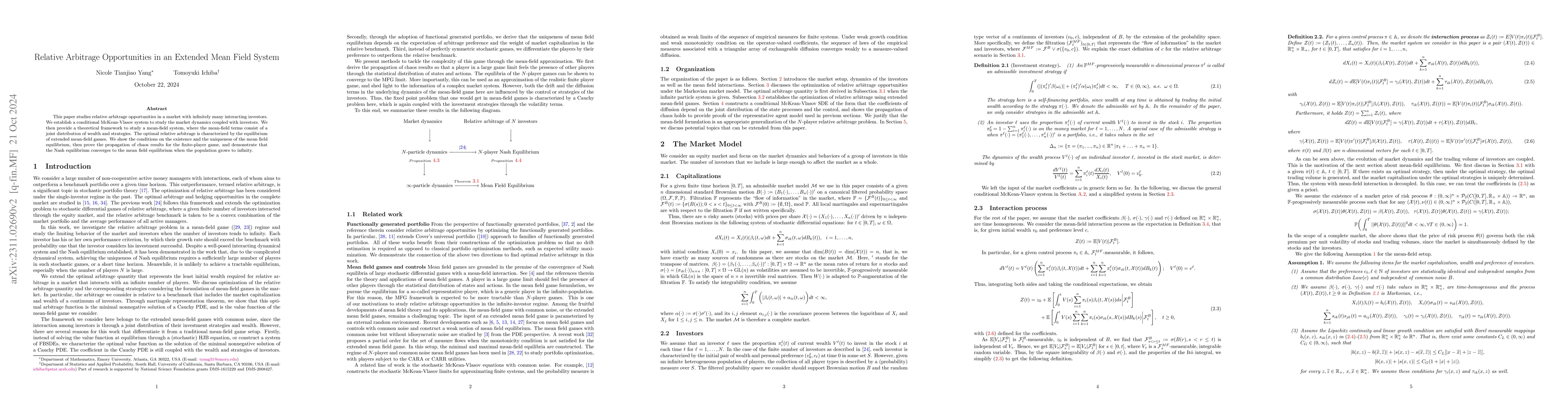

This paper studies relative arbitrage opportunities in a market with infinitely many interacting investors. We establish a conditional McKean-Vlasov system to study the market dynamics coupled with investors. We then provide a theoretical framework to study a mean-field system, where the mean-field terms consist of a joint distribution of wealth and strategies. The optimal relative arbitrage is characterized by the equilibrium of extended mean field games. We show the conditions on the existence and the uniqueness of the mean field equilibrium, then prove the propagation of chaos results for the finite-player game, and demonstrate that the Nash equilibrium converges to the mean field equilibrium when the population grows to infinity.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)