Summary

We calculate explicitly the optimal strategy for an investor with exponential utility function when the stock price follows an autoregressive Gaussian process. We also calculate its performance and analyse it when the trading horizon tends to infinity. Dependence of asymptotic performance on the autoregression parameter is determined. This provides, to the best of our knowledge, the first instance of a theorem linking directly the memory of the asset price process to the attainable satisfaction level of investors trading in the given asset.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

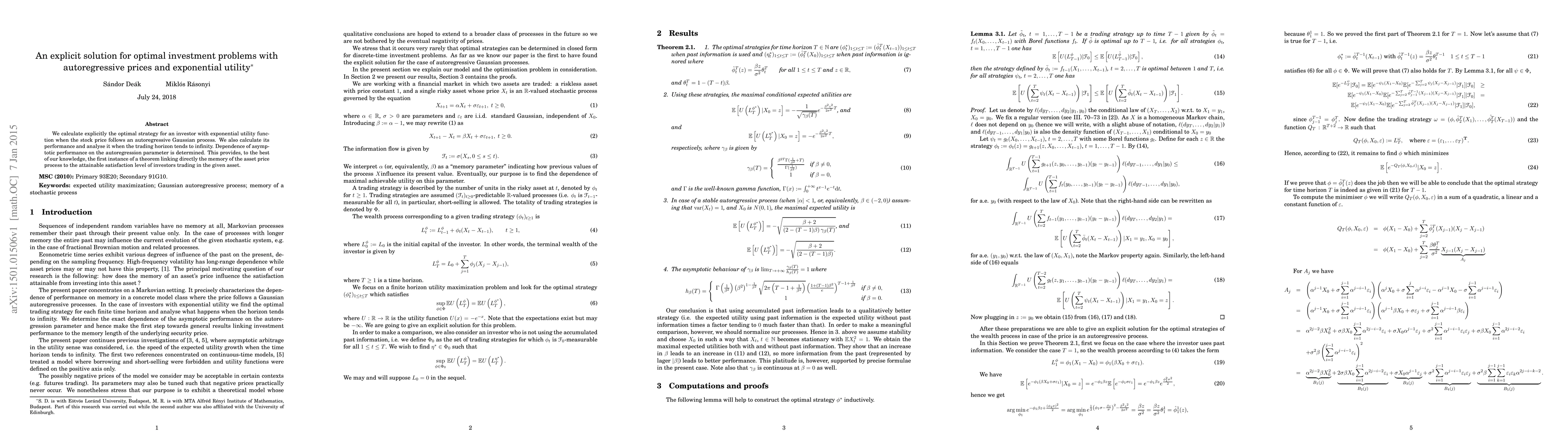

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn Explicit Solution for the Problem of Optimal Investment with Random Endowment

Christoph Knochenhauer, Michael Donisch

Optimal investment with a noisy signal of future stock prices

Yan Dolinsky, Peter Bank

| Title | Authors | Year | Actions |

|---|

Comments (0)