Summary

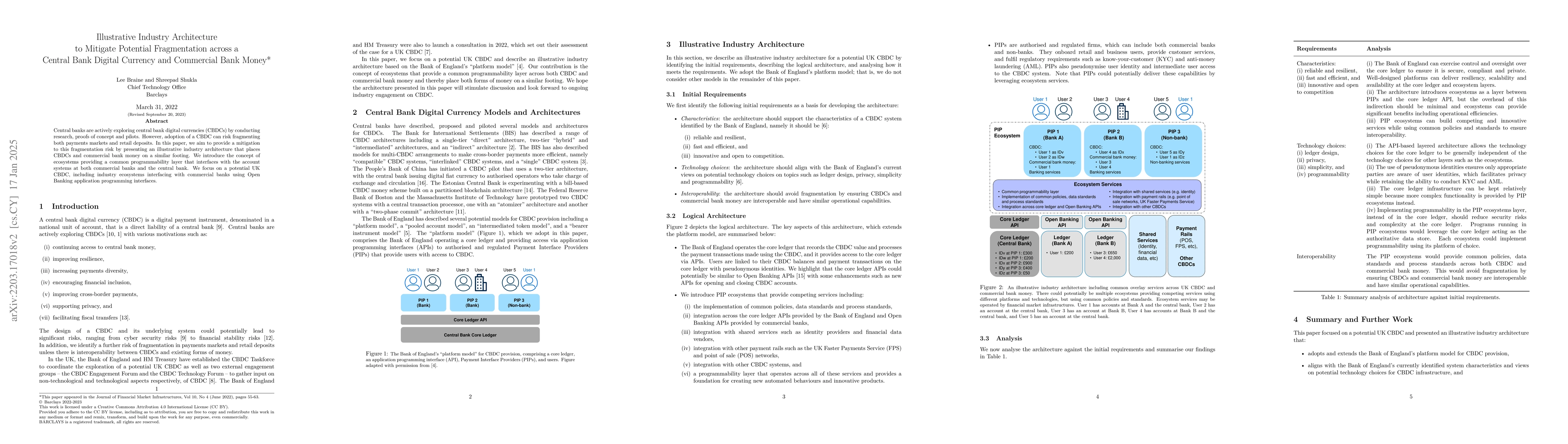

Central banks are actively exploring central bank digital currencies (CBDCs) by conducting research, proofs of concept and pilots. However, adoption of a CBDC can risk fragmenting both payments markets and retail deposits. In this paper, we aim to provide a mitigation to this fragmentation risk by presenting an illustrative industry architecture which places CBDCs and commercial bank money on a similar footing. We introduce the concept of ecosystems providing a common programmability layer that interfaces with the account systems at both commercial banks and the central bank. We focus on a potential United Kingdom (UK) CBDC, including industry ecosystems interfacing with commercial banks using Open Banking application programming interfaces (APIs).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFunctional Consistency across Retail Central Bank Digital Currency and Commercial Bank Money

Piyush Agrawal, Lee Braine, Shreepad Shukla

A Privacy-preserving Central Bank Ledger for Central Bank Digital Currency

Wang Mong Tikvah Chan

Analysis of the Impact of Central bank Digital Currency on the Demand for Transactional Currency

Chunhui Zhou, Ruimin Song, Tiantian Zhao

Retail Central Bank Digital Currency: Motivations, Opportunities, and Mistakes

Tomaso Aste, Geoffrey Goodell, Hazem Danny Al-Nakib

| Title | Authors | Year | Actions |

|---|

Comments (0)