Summary

This paper proves that the welfare of the first price auction in Bayes-Nash equilibrium is at least a $.743$-fraction of the welfare of the optimal mechanism assuming agents' values are independently distributed. The previous best bound was $1-1/e \approx .63$, derived in Syrgkanis and Tardos (2013) using smoothness, the standard technique for reasoning about welfare of games in equilibrium. In the worst known example (from Hartline et al. (2014)), the first price auction achieves a $\approx .869$-fraction of the optimal welfare, far better than the theoretical guarantee. Despite this large gap, it was unclear whether the $1-1/e \approx .63$ bound was tight. We prove that it is not. Our analysis eschews smoothness, and instead uses the independence assumption on agents' value distributions to give a more careful accounting of the welfare contribution of agents who win despite not having the highest value.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

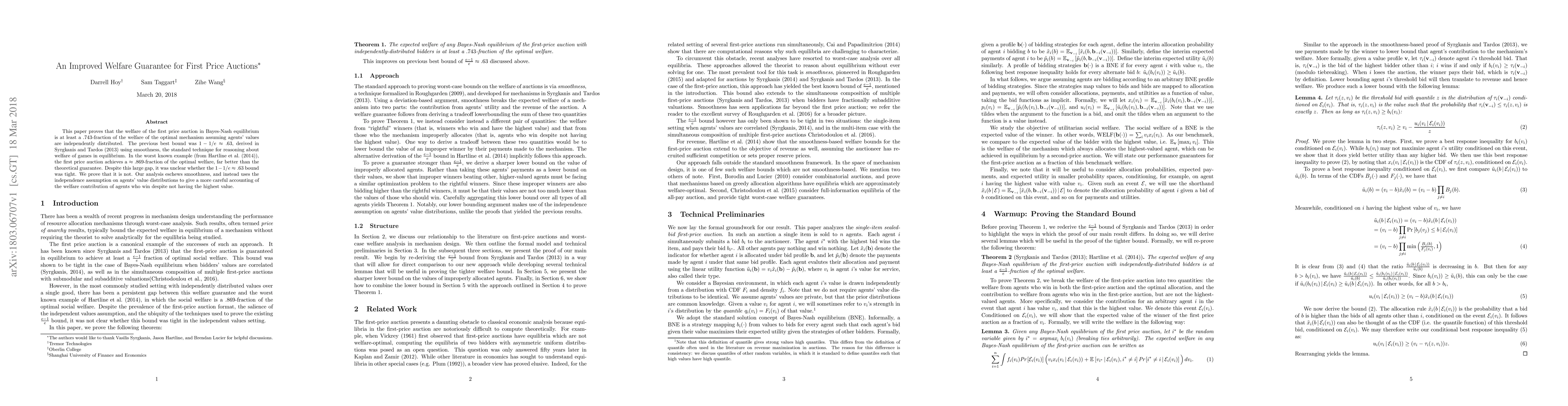

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrice Manipulability in First-Price Auctions

Paul Dütting, Balasubramanian Sivan, Johannes Brustle

Liquid Welfare Guarantees for No-Regret Learning in Sequential Budgeted Auctions

Éva Tardos, Giannis Fikioris

| Title | Authors | Year | Actions |

|---|

Comments (0)