Summary

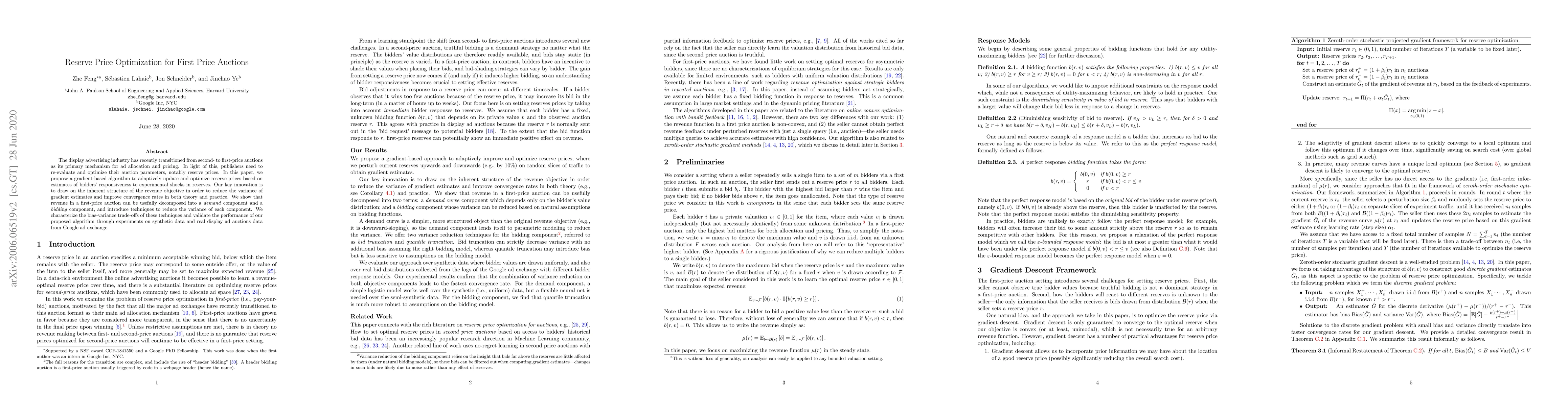

The display advertising industry has recently transitioned from second- to first-price auctions as its primary mechanism for ad allocation and pricing. In light of this, publishers need to re-evaluate and optimize their auction parameters, notably reserve prices. In this paper, we propose a gradient-based algorithm to adaptively update and optimize reserve prices based on estimates of bidders' responsiveness to experimental shocks in reserves. Our key innovation is to draw on the inherent structure of the revenue objective in order to reduce the variance of gradient estimates and improve convergence rates in both theory and practice. We show that revenue in a first-price auction can be usefully decomposed into a \emph{demand} component and a \emph{bidding} component, and introduce techniques to reduce the variance of each component. We characterize the bias-variance trade-offs of these techniques and validate the performance of our proposed algorithm through experiments on synthetic data and real display ad auctions data from Google ad exchange.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrice Manipulability in First-Price Auctions

Paul Dütting, Balasubramanian Sivan, Johannes Brustle

| Title | Authors | Year | Actions |

|---|

Comments (0)