Summary

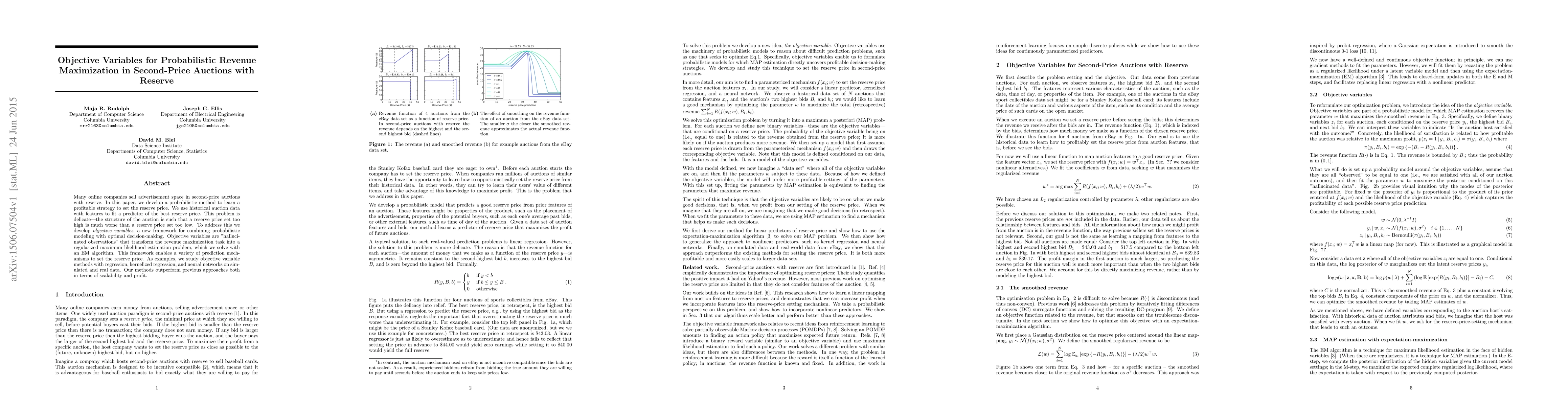

Many online companies sell advertisement space in second-price auctions with reserve. In this paper, we develop a probabilistic method to learn a profitable strategy to set the reserve price. We use historical auction data with features to fit a predictor of the best reserve price. This problem is delicate - the structure of the auction is such that a reserve price set too high is much worse than a reserve price set too low. To address this we develop objective variables, a new framework for combining probabilistic modeling with optimal decision-making. Objective variables are "hallucinated observations" that transform the revenue maximization task into a regularized maximum likelihood estimation problem, which we solve with an EM algorithm. This framework enables a variety of prediction mechanisms to set the reserve price. As examples, we study objective variable methods with regression, kernelized regression, and neural networks on simulated and real data. Our methods outperform previous approaches both in terms of scalability and profit.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersApproximate Revenue Maximization for Diffusion Auctions

Bin Li, Zhiyi Fan, Yuhang Guo et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)