Summary

Empirical growth analysis has three major problems --- variable selection, parameter heterogeneity and cross-sectional dependence --- which are addressed independently from each other in most studies. The purpose of this study is to propose an integrated framework that extends the conventional linear growth regression model to allow for parameter heterogeneity and cross-sectional error dependence, while simultaneously performing variable selection. We also derive the asymptotic properties of the estimator under both low and high dimensions, and further investigate the finite sample performance of the estimator through Monte Carlo simulations. We apply the framework to a dataset of 89 countries over the period from 1960 to 2014. Our results reveal some cross-country patterns not found in previous studies (e.g., "middle income trap hypothesis", "natural resources curse hypothesis", "religion works via belief, not practice", etc.).

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

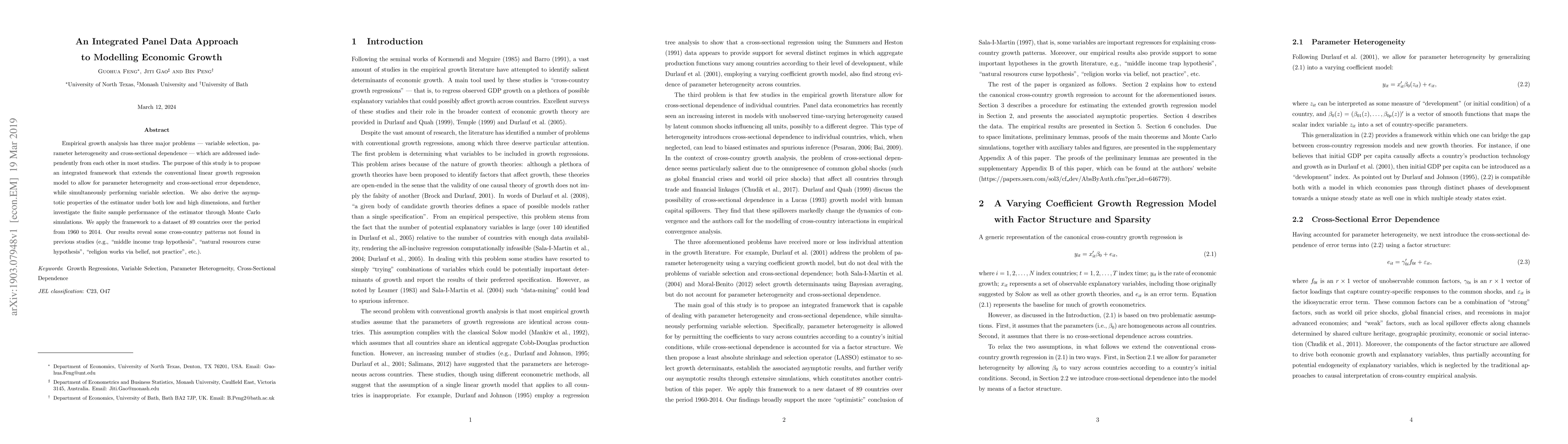

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)