Summary

The purpose of this paper is to analyze and compute the early exercise boundary for a class of nonlinear Black--Scholes equations with a nonlinear volatility which can be a function of the second derivative of the option price itself. A motivation for studying the nonlinear Black--Scholes equation with a nonlinear volatility arises from option pricing models taking into account e.g. nontrivial transaction costs, investor's preferences, feedback and illiquid markets effects and risk from a volatile (unprotected) portfolio. We present a new method how to transform the free boundary problem for the early exercise boundary position into a solution of a time depending nonlinear parabolic equation defined on a fixed domain. We furthermore propose an iterative numerical scheme that can be used to find an approximation of the free boundary. We present results of numerical approximation of the early exercise boundary for various types of nonlinear Black--Scholes equations and we discuss dependence of the free boundary on various model parameters.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

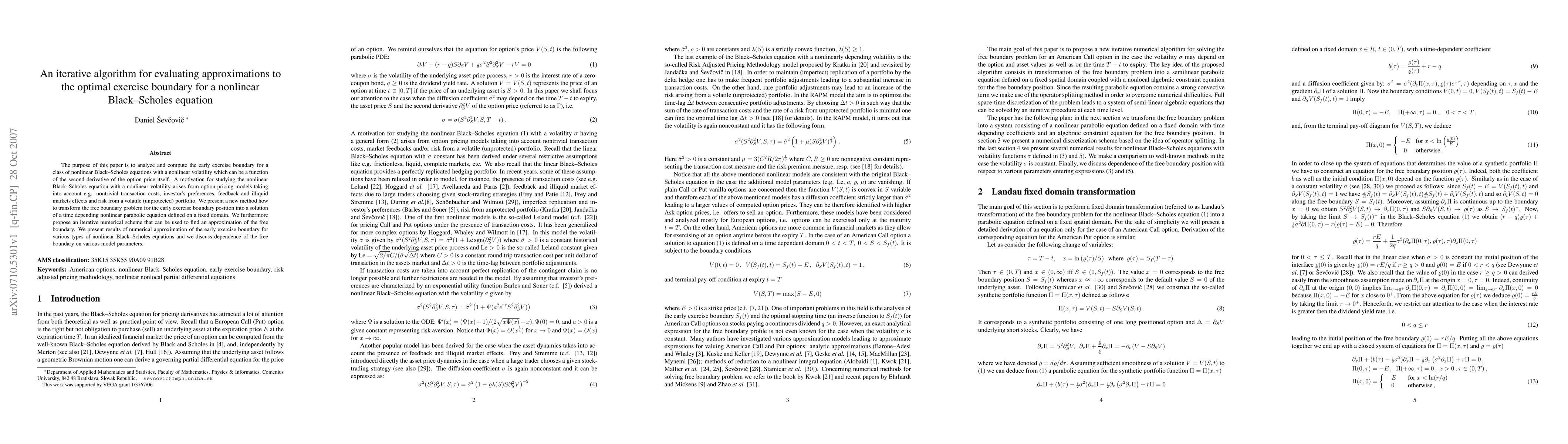

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

| Title | Authors | Year | Actions |

|---|

Comments (0)