Authors

Summary

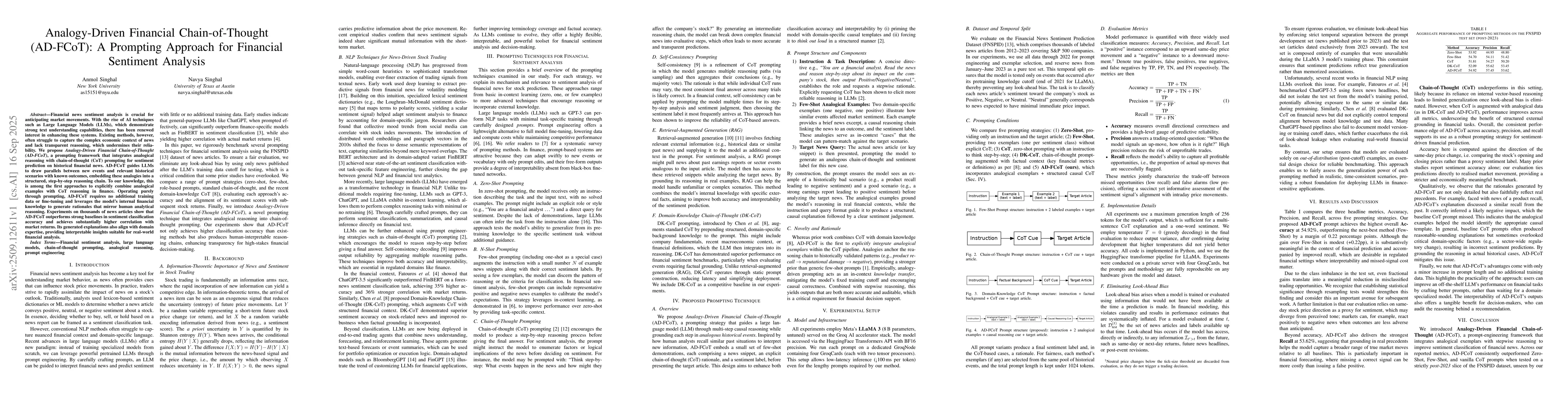

Financial news sentiment analysis is crucial for anticipating market movements. With the rise of AI techniques such as Large Language Models (LLMs), which demonstrate strong text understanding capabilities, there has been renewed interest in enhancing these systems. Existing methods, however, often struggle to capture the complex economic context of news and lack transparent reasoning, which undermines their reliability. We propose Analogy-Driven Financial Chain-of-Thought (AD-FCoT), a prompting framework that integrates analogical reasoning with chain-of-thought (CoT) prompting for sentiment prediction on historical financial news. AD-FCoT guides LLMs to draw parallels between new events and relevant historical scenarios with known outcomes, embedding these analogies into a structured, step-by-step reasoning chain. To our knowledge, this is among the first approaches to explicitly combine analogical examples with CoT reasoning in finance. Operating purely through prompting, AD-FCoT requires no additional training data or fine-tuning and leverages the model's internal financial knowledge to generate rationales that mirror human analytical reasoning. Experiments on thousands of news articles show that AD-FCoT outperforms strong baselines in sentiment classification accuracy and achieves substantially higher correlation with market returns. Its generated explanations also align with domain expertise, providing interpretable insights suitable for real-world financial analysis.

AI Key Findings

Generated Sep 22, 2025

Methodology

The research proposes AD-FCoT, a prompting framework that integrates analogical reasoning with chain-of-thought (CoT) prompting to enhance financial sentiment analysis. It uses LLMs to generate structured reasoning chains by drawing parallels between new financial news and historical scenarios with known outcomes, without requiring additional training data or fine-tuning.

Key Results

- AD-FCoT achieves the highest accuracy (54.92%) and recall (53.62%) compared to other prompting strategies on the FNSPID test set.

- It demonstrates stronger correlation with market returns than existing methods, indicating improved predictive power.

- The generated explanations align with domain expertise, offering interpretable insights suitable for financial decision-making.

Significance

This research advances financial sentiment analysis by providing a reliable, interpretable framework that enhances both accuracy and transparency. It addresses critical challenges in financial NLP by leveraging analogical reasoning and structured prompting, enabling better market prediction and decision support in regulated environments.

Technical Contribution

AD-FCoT introduces a novel prompting strategy that combines analogical examples with structured causal reasoning, enabling LLMs to generate interpretable and accurate financial sentiment predictions without additional training.

Novelty

AD-FCoT is the first approach to explicitly integrate analogical exemplars within the CoT framework for financial sentiment analysis, providing a stronger prior through historically validated patterns compared to generic few-shot prompting.

Limitations

- Evaluation relies on same-day price direction as a proxy for sentiment, which may not fully capture perceived tone.

- The study focuses on English financial news, limiting generalizability to other languages or regions.

Future Work

- Automate analogy retrieval and integration with numerical reasoning tools in the CoT pipeline.

- Extend evaluation to multilingual corpora and explore performance under class imbalance.

- Investigate which components of AD-FCoT contribute most to its performance gains.

Paper Details

PDF Preview

Similar Papers

Found 4 papersReasoning or Overthinking: Evaluating Large Language Models on Financial Sentiment Analysis

Dhagash Mehta, Dimitris Vamvourellis

EFSA: Towards Event-Level Financial Sentiment Analysis

Qing He, Tianyu Chen, Yiming Zhang et al.

FinCoT: Grounding Chain-of-Thought in Expert Financial Reasoning

Potsawee Manakul, Kunat Pipatanakul, Pittawat Taveekitworachai et al.

Comments (0)