Authors

Summary

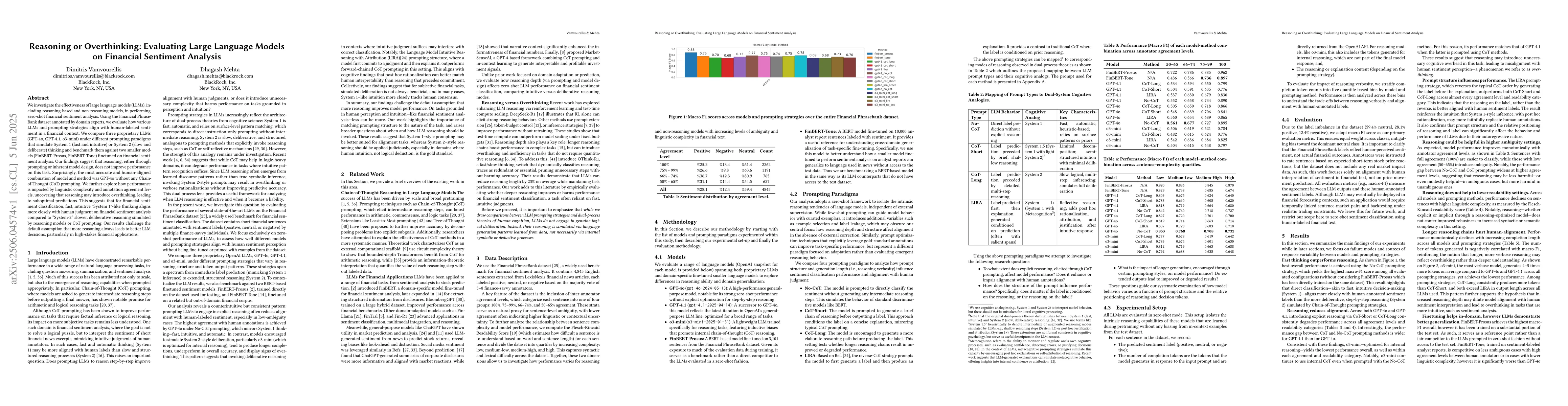

We investigate the effectiveness of large language models (LLMs), including reasoning-based and non-reasoning models, in performing zero-shot financial sentiment analysis. Using the Financial PhraseBank dataset annotated by domain experts, we evaluate how various LLMs and prompting strategies align with human-labeled sentiment in a financial context. We compare three proprietary LLMs (GPT-4o, GPT-4.1, o3-mini) under different prompting paradigms that simulate System 1 (fast and intuitive) or System 2 (slow and deliberate) thinking and benchmark them against two smaller models (FinBERT-Prosus, FinBERT-Tone) fine-tuned on financial sentiment analysis. Our findings suggest that reasoning, either through prompting or inherent model design, does not improve performance on this task. Surprisingly, the most accurate and human-aligned combination of model and method was GPT-4o without any Chain-of-Thought (CoT) prompting. We further explore how performance is impacted by linguistic complexity and annotation agreement levels, uncovering that reasoning may introduce overthinking, leading to suboptimal predictions. This suggests that for financial sentiment classification, fast, intuitive "System 1"-like thinking aligns more closely with human judgment compared to "System 2"-style slower, deliberative reasoning simulated by reasoning models or CoT prompting. Our results challenge the default assumption that more reasoning always leads to better LLM decisions, particularly in high-stakes financial applications.

AI Key Findings

Generated Jun 09, 2025

Methodology

The study evaluates the performance of large language models (LLMs), including reasoning-based and non-reasoning models, on zero-shot financial sentiment analysis using the Financial PhraseBank dataset. It compares three proprietary LLMs (GPT-4o, GPT-4.1, o3-mini) with different prompting strategies simulating System 1 (fast, intuitive) and System 2 (slow, deliberate) thinking against two smaller fine-tuned models (FinBERT-Prosus, FinBERT-Tone).

Key Results

- Reasoning, whether through prompting or inherent model design, does not enhance performance on financial sentiment analysis.

- GPT-4o without Chain-of-Thought (CoT) prompting showed the most accuracy and alignment with human judgment.

- Reasoning may introduce overthinking, leading to suboptimal predictions in financial sentiment classification.

Significance

This research challenges the assumption that more reasoning always leads to better LLM decisions, especially in high-stakes financial applications, and highlights the importance of intuitive 'System 1'-like thinking for financial sentiment classification.

Technical Contribution

Demonstrates that intuitive, fast thinking aligns better with human judgment in financial sentiment classification than deliberative reasoning simulated by LLMs or CoT prompting.

Novelty

Contradicts the prevailing notion that enhanced reasoning capabilities in LLMs invariably improve performance, particularly in complex domains like finance.

Limitations

- The study focuses on zero-shot analysis, which may not fully capture the capabilities of models with fine-tuning.

- Findings are based on a specific dataset (Financial PhraseBank), limiting generalizability to other financial text domains.

Future Work

- Investigate the impact of fine-tuning LLMs on financial sentiment analysis tasks.

- Explore the performance of these models across diverse financial text datasets and domains.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEvaluating Company-specific Biases in Financial Sentiment Analysis using Large Language Models

Masanori Hirano, Kei Nakagawa, Yugo Fujimoto

Financial Sentiment Analysis on News and Reports Using Large Language Models and FinBERT

Yanxin Shen, Pulin Kirin Zhang

Chinese Fine-Grained Financial Sentiment Analysis with Large Language Models

Wang Xu, Yanru Wu, Yinyu Lan et al.

Enhancing Financial Sentiment Analysis via Retrieval Augmented Large Language Models

Xiao-Yang Liu, Hongyang Yang, Boyu Zhang et al.

No citations found for this paper.

Comments (0)